Do you want to embed a Bank in your Business? The future of BaaS and platformization of Banking

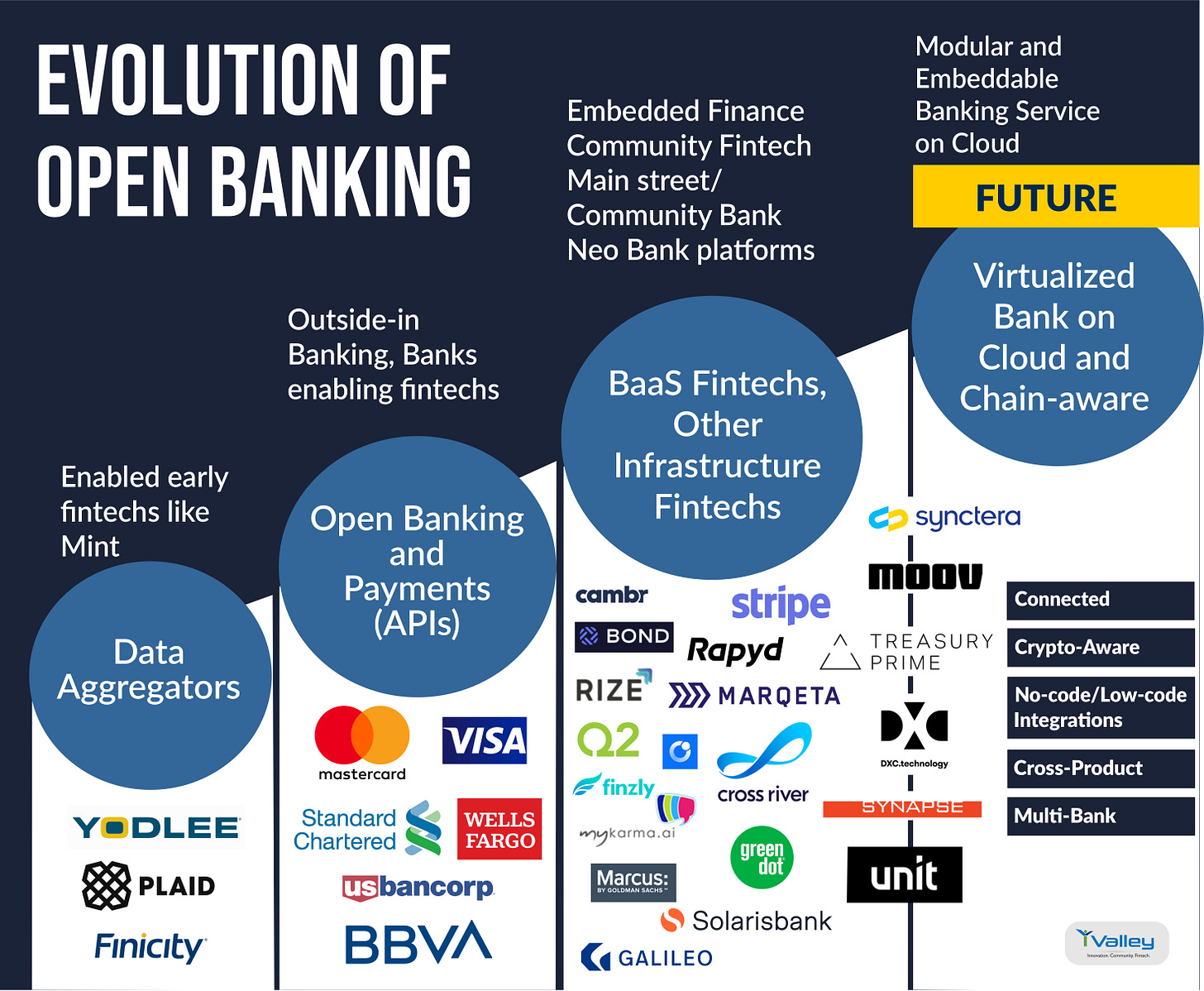

Banking is getting virtualized. Next-generation fintechs are making Banking services embeddable (not just accessible) to any business.

HI FINTECHTALKERS,

Remember how Java changed the programming world in the 90s by making it easy for developers to build and deploy on any platform. How open-source Linux standardized operating systems across hardware types. And how Kubernetes changed the virtualization of disparate computing and storage resources. The same is happening in Banking. Banking services are becoming virtualized. Let me explain.

Innovative fintechs and forward-thinking core providers are disentangling the software that powers Banking and making it open-source, modular, on the cloud, and easy to access such that any fintech, or SaaS provider or main street business can leverage and/or embed banking and payments services into their offering. This virtualization of Banking (similar to virtualization of computing and storage resources) will not only make Banking easy to access and embed but will change the economics of Banking.

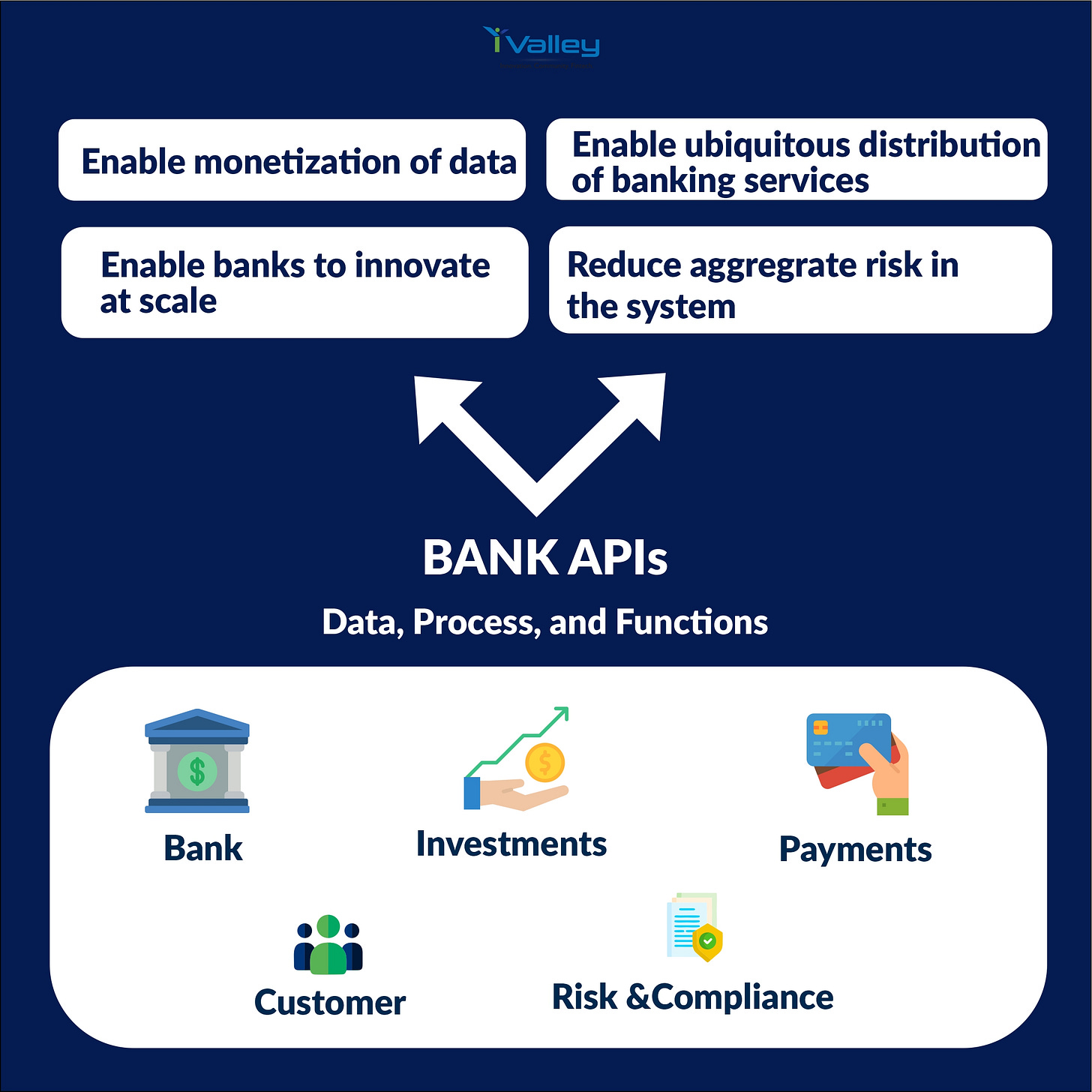

I wrote about The API Opportunity in Banking in 2014 (infograph below) of how an API as a channel for Banks will enable monetization of data (what Plaid, Yodlee, Finicity successfully did), and enable ubiquitous distribution of banking services (all customer journey fintechs like wallets, challenger banks, neoWealth apps, BNPL providers, etc).

To continue the thread about seven years later, last week, I sat down with Peter Hazlehurst CEO of Synctera, Wade Arnold CEO of Moov, Eric Purdum GM at DXC Technology, Howard Klein at CFSB Bank, and Matt Michaelis CEO at Emprise Bank to discuss the future of platformization in banking and embedded finance. A succinct recap of the conversation by the Fintech Elder and our editorial epilogue is included below.

While Banks will not go away, Banking will become a virtualized Cloud service (few clicks or a few lines of code to embed), chain-aware and available for Fintechs, SaaS, and any other main street business that want to incorporate finance into their business.

These ubiquitous embedded finance models could change the overall economics of Banking - how assets are leveraged, and the interchange economics. Banking services will not only become embeddable but they will become more need and context-aware, hyper-personalized, and intelligent - from product-centric to service-centric.

Most Banks lost out to an extent capturing value from the first generation of Open Banking and Payments as they could not see what outsiders like Plaid, Stripe, and some Banks like Bankcorp saw - this time will not be as forgiving. It’s not just distribution that is changing but the factory and the economics.

To join iValley to partner and build these virtual banks, click here, a 3rd generation startup factory, building, talking, and writing about the fintech, crypto-economy, and web 3.0 future we are creating with our ecosystems of startups, investors, and corporates.

Enjoy and always Be in the Know,

Paddy Ramanathan

Founder of iValley and Host of the FINTECHTALK™ Show

Do you want to embed a Bank in your Business? It is easy!

Recap of June 9th FINTECHTALK Show on Banking/Fintech as a Service and Embedded Finance by the FINTECH ELDER

I listened quietly from the shadows to a fascinating and passionate Clubhouse discussion on June 9th, Banking/Fintech as a Service and Embedded Finance, moderated by the affable Paddy Ramanathan, CEO of the Fintech enabler iValley.

The cast was very impressive! Take a look:

Howard Klein, President, Merchant Services & Payments at Peoples Trust

Peter Hazlehurst, Co-Founder and CEO at Synctera

Eric Purdum, General Manager for the DXC Luxoft Banking Segment

Matt Michaelis, Chairman & CEO at Emprise Bank

Wade Arnold, CEO of Moov

It’s difficult to summarize a fairly vivid discussion that covered a lot of ground. Many interesting points and perspectives emerged, moderated deftly by Paddy.

First, many traditional banks were in a denial mode for quite a while but have now moved on to adopt a clear cloud strategy and are working closely with Fintechs, Changing customer profiles and expectations have spurred demand for the seamless integration of financial services into a traditionally non-financial service.

Second, there is a move to make much of banking software open source. That will render proprietary software unviable and will make embedded finance a de facto way of conducting banking.

An interesting new challenge is that of incentivizing developers and encouraging them to collaborate. (And that’s happening: MOOV is hosting a developers’ conference, Fintech Devcon Sep 8-9 in Denver, CO. Please use promo code moovfriends at checkout for fintech_devcon tickets and that will take 15% off. Tell them the Fintech Elder sent you!)

Did you know, there are millions of lines of code (in COBOL!) that still drive the banking world? Replacing them is easier said than done. The effort is to try to replace them by open source, allowing a spirit of collaboration between developers. As Wade said, nerds are working hard to build connectors and libraries. The future is bright!

Third, smaller financial institutions like credit unions and community banks will use fintech to compete equally with larger banks with deep pockets. Fintechs are better at acquiring customers and have more inclusive products. Community banks are evolving rapidly, and they have a responsibility to support fledging fintechs as they evolve. Peter’s mandate is to help community banks enter the fintech marketplace. Helping them with compliance is the first step, followed by operational efficiency and scaling.

Fourth, the term embedded banking really suggests that banking ought to originate in the ecosystem which a customer prefers. In other words, go where the eyeballs are! Simple, straightforward!

An additional understanding of the customer is warranted; as Matt said, no one really wants to bank. They want a home, not a mortgage, and so on. Understanding the context is critical to the success of embedded banking.

It’s probably true that traditional banks have woken up to the reality of neo banks and challenger banks. The churn in the world of Fintech and Community Banking has added to that cold reality: objects in the mirror are closer than they appear.

Things are poised to change drastically. The very concept of a bank and the experience of banking will be unrecognizable in a couple of years. That’s some serious food for thought.

As I drove away from the event in my Porsche, I glanced repeatedly at the rear-view mirror. I’m getting paranoid.

The Fintech Elder is a seer and visionary. You can bank on him.

EPILOGUE - THE VIRTUALIZATION OF THE BANK

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd, E-909

San Ramon, CA 94582,

United States.

Phone: +1 925-575-7832