Fintech SPACs, Digital Banks, Digital Assets and Lenders Dilemma

eFINTECHTALK - iValley’s Fintech Newsletter - Be in the know

Fintech fragments and musings from Paddy

Billion dollars of SPACs raised for Fintech acquisitions, segment-specific digital banks getting funding, real estate lending on fire while small business lending fintechs exit in firesales, Blockchain or Decentralized Finance (DeFi) demystified (again) and why Bitcoin as an inflationary hedge is apocryphal

The Future of Digital Asset and Decentralized Finance (DeFi)

There are broadly three camps in the Defi world with very different views of how Blockchain or DeFi systems will evolve:

The Bitcoin as the ultimate inflation and apocalypse hedge camp (a variant of this group focuses on the broader cryptocurrency space than just Bitcoin) - an alternate financial infrastructure

The enterprise or permissioned blockchain camp creating more efficient financial services

The naysayers who say a database can do what a blockchain does much better and faster

All have a point but each camp misses the holistic view and the limiting factors that are in play. Let me explain.

Bitcoin value will drop with more stable coins and CBDC initiatives

In a decentralized network like Bitcoin, the value of the network increases with more participants or nodes. The value is accretive to the network as a whole and typically early adopters get the larger share of the value addition. For example, the first 100 buyers of Bitcoin have better returns vs. the first time buyer today. Bitcoin intrinsically does not have any utility nor does it have any value (say in comparison to a precious metal like Gold) and is of finite quantity by design. It has no yield so its value entirely depends on demand and the number of people buying into it. This explains why folks who have bet on Bitcoin already, keep promoting it as the next best thing since Gold (literally) as they stand to gain the most. While some believe its potential (like a precious metal) hedge against inflation and as an apocalypse hedge (like a COVID-19 like crisis creating hyperinflation or another dire economic state). I don’t buy into this. The value of a currency like the US Dollar is not because of the Federal Reserve’s monetary policy but the strength of the US economy, the faith in its people and system of government, and other aspects that mitigate systemic risk. I just find the Bitcoin whales and bulls position of it being a hedge as apocryphal and self-serving to their interest.

As to the other camps, I think the answer lies in computational economics. Decentralized networks in finance and commerce will work best where the cost of building consensus and proof of work is less than the cost of centralization. Computer speed/network bandwidth and loss/fraud in the network would be a threshold determinant for viability. Consensus and proof of work are inefficient, especially in large multi-node networks. In conclusion, we will see more DeFi governed by the valuation principle and the cost of consensus principles outlined above. I am planning to write more on this topic but am interested in hearing from you.

Digital Banks and Banking as a Service (BaaS)

We noted the different flavors of digital banks and posited the potential convergences into a lifestyle app in our last newsletter. August had some new segment-specific or lifestyle apps for certain segments closing their Series A funding rounds. Notable are Copper, a digital bank with financial literacy focus for teens, and Purple, a tech focusing on the needs of special needs individuals or individuals with disabilities. These deals underscore the overarching point around digital banking and payments being part of an overall lifestyle app that banks and challenger banks should take heed. While the same monetization principles of deposits or assets and transaction (interchange) apply to the digital bank, engagement becomes a key differentiator which ties back to the lifestyle metaphor.

The Lenders Dilemma

COVID-19 may have been the final straw but the lack of breadth and diversification for monoline small business lenders like OnDeck and Kabbage saw both these fintech poster children being bought out on fire sales. The story is quite different on the real estate lending side. The low-interest-rate environment and what appears to be a migration from Metros saw huge valuations for Blend ($1.7 Billion), and huge premiums for Optimal Blue and Ellie Mae (April 2019 purchased by Thoma Bravo for $3.7 Billion and on Aug 2020 purchased by Intercontinental exchange for $11 Billion). Most of these valuations are transaction-related rather than the return on asset, reinforcing that transaction revenue is driving fintech valuation.

Investors Corner and SPAC Watch

Special Purpose Acquisition Company (SPAC), aka blank check firms, are in vogue these days. SPACs work by raising capital first and then shopping for a private company to buy (or companies) in a specific area. They are an alternate path than the more rigorous IPO for private companies to raise public capital. There were some SPACs in fintech dating as early as 2015 but this year has seen several new SPACs in Fintech. There are at least 60 fintech Unicorns (including about five with over $10B in valuation) with a collective valuation exceeding $100 Billion. SPACs can provide some of these unicorns liquidity and additional capital to scale organically or through M&As and a path to a public listing like the recent BankMobile acquisition by the Megalith Financial Services Acquisition (MFAC). We will be tracking and bringing you SPAC activity in fintech and technology in our newsletter going forward including which companies maybe target.

Paddy Ramanathan

Founder and Managing Director of iValley Innovation Center and

the host of FINTECHTALK™, the intersection of silicon valley and financial services event.

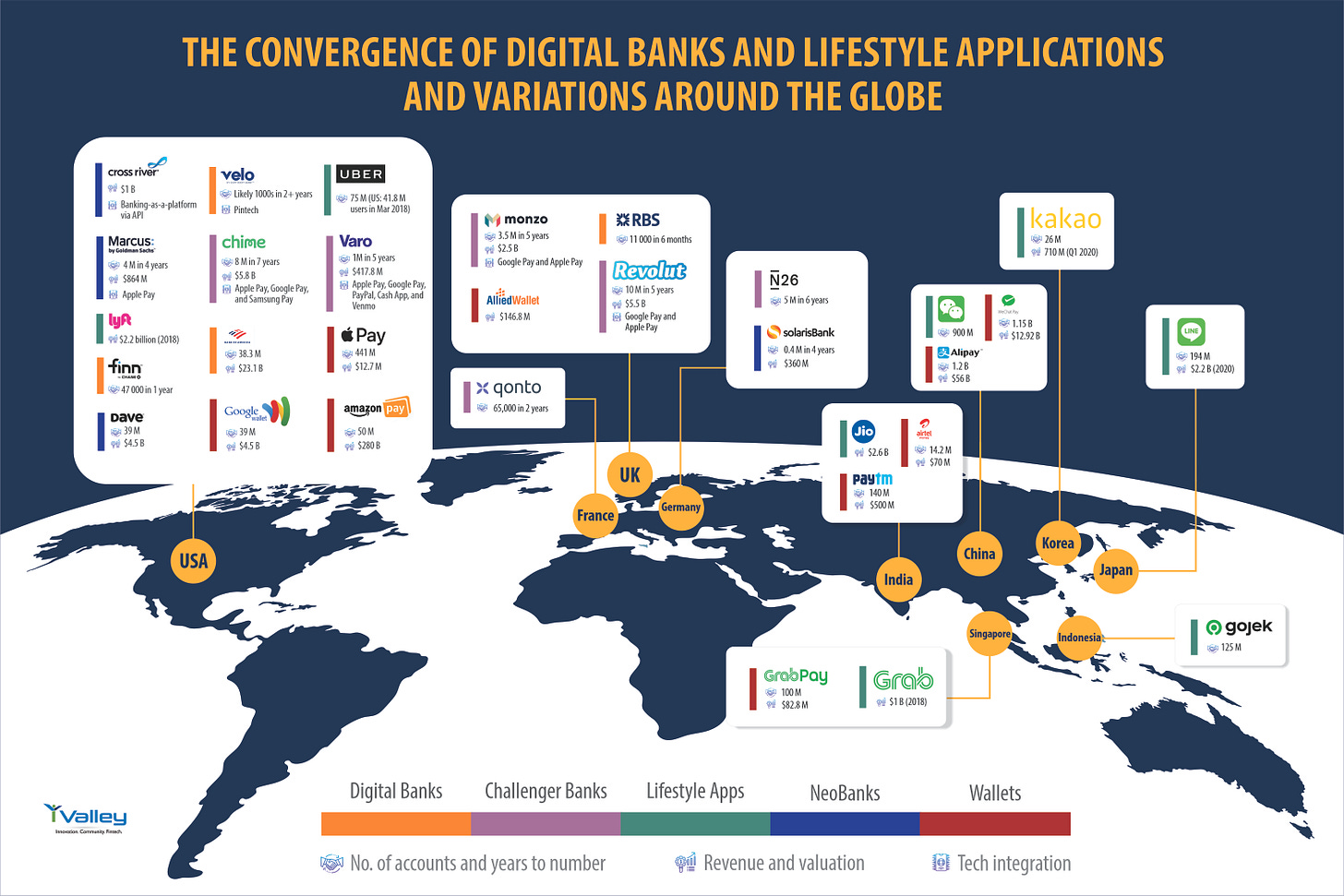

The Convergence of Digital Banks and Lifestyle Applications and Variations Around the Globe

Sneak preview from our research team on of an upcoming Digital Bank trends report. Drop us a mail at info@ivalley.co to share your thoughts or if you want to know more.

FINTECHTALK™ OVER THE YEARS

FINTECHTALK™ was organized as a platform to fuel thought leadership in the fintech space. The event also provided startups an opportunity to pitch their business to investors, connect with industry leaders and be in the know of all things fintech. This video talks about how FINTECHTALK™ was instrumental in pioneering thought leadership in fintech and in catalyzing the growth of startups.

TOP STORIES AND NEWS

US Challenger Purple to Tap America’s Disabled Community

Purple, a Florida-based challenger which recently rebranded from ‘youBelong’, is gearing up to serve America’s disabled community. The fintech allows users to receive disability benefits up to two days early. Currently, it is working on a voice-powered banking service with Microsoft. Purple intends to serve both those with … Read on.

Digital Bank Startup Copper Raises $4.3M to Help Teens Learn How to Spend and Save Money

Can tech help teens spend money smarter? That’s the bet Copper and its investors are making. The Seattle-based digital bank startup just announced a $4.3 million seed round led by PSL Ventures, the venture capital arm of Pioneer Square Labs. Jack Brody, director of product at Snap, along with Mana Ventures and … Read on.

SPAC to Acquire BankMobile at $140M Enterprise Value

Megalith Financial Acquisition Corp. on Aug. 6 agreed to acquire BankMobile Technologies, a unit of Phoenixville, Pa.-based Customers Bank, a unit of Customers Bancorp Inc., in a deal that reflects an enterprise value of $140 million. Customers Bancorp Chairman and CEO Jay Sidhu is also the executive chairman … Read on.

Amex Acquires SoftBank-backed Kabbage After Tough 2020 for the SMB Lender

Small and medium businesses have been some of the hardest hit in the coronavirus pandemic, and in many cases that has had a knock-on effect on the companies that provide services to them. Now, a startup that built a whole business around loaning money to SMBs has been acquired by a giant in the world of credit as the … Read on.

Digital Loan Start-up Blend Jumps to $1.7 billion Valuation as Mortgage Demand Surges

Digital lending start-up Blend raised $75 million in fresh funding amid surging demand for streamlined mortgage applications during the coronavirus pandemic. The move values the company at almost $1.7 billion, a jump of more than 70% from its previous funding round a year earlier, CNBC has learned. Blend is … Read on.

Centre Consortium Announces Release of USD Coin Version 2.0

Centre Consortium members Circle and Coinbase today announced a major upgrade to the USD Coin (USDC) protocol and smart contract, making it significantly easier for people to use USDC in payments, commerce and peer-to-peer transactions. The update also adds additional security infrastructure to the USDC smart … Read on.

Black Knight to Acquire Optimal Blue in $1.8B Deal to Boost Origination Offerings

Just weeks after published reports that Optimal Blue was up for sale, fintech giant Black Knight Inc. announced this morning it will buy the Dallas-based company for $1.8 billion. The price is a hefty premium over the $350 million Chicago-based private equity firm GTCR LLC paid for the company in 2016 as part of a … Read on.

Intercontinental Exchange Enters Definitive Agreement to Acquire Ellie Mae from

Thoma Bravo

Intercontinental Exchange (NYSE: ICE), a leading operator of global exchanges and clearing houses and provider of mortgage technology, data and listing services, announced today that it has entered into a definitive agreement to acquire Ellie Mae®, the leading cloud-based platform provider for the mortgage finance … Read on.

Varo Becomes First Consumer Fintech to Land a National Charter

Chief Executive Officer Colin Walsh encountered skepticism when his technology startup set out five years ago to become a full-service digital bank. “Yeah, right, good luck with that,” he recalled a future partner saying. Now Varo is the first consumer fintech to receive a new national bank charter from the U.S. government … Read on.

New Blank-check Company from Bancorp Founder Lays Groundwork for a Fintech Deal

A new shell company set up by a former banking CEO is set to go public this week, with the eventual plan to buy up a fintech company. The special purpose acquisition company -- also known as a SPAC -- will list on the Nasdaq Wednesday morning, according to its executives. Betsy Cohen, who founded and once ran … Read on.

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd,

San Ramon, CA 94582,

United States.

Phone: +1 925-575-7832