From new Rails to Agents: Finance’s Triple Shift

Upgraded infrastructure, TradFi–DeFi convergence, and agent-led commerce turning payments into growth.

Thesis: We’re moving from “features on legacy rails” to programmable, money on increasingly on-chain infrastructure. Tokenization is a means; infrastructure is the story. Eventually, programmable money can think and choose with Agents.

1) Infrastructure is shifting on-chain — and that will change the fabric of finance in banking and capital markets.

Policy tailwinds. Under the Trump administration’s policy direction, industry has clearer federal guidance for digital-asset rails and regulatory clarity—with the passage of Genius Act and an expected passage of the market structure Clarity Act. The industry is reading the signal clearly: legislative and regulatory clarity is enabling both incumbents and startups to innovate and launch new services. It’s catalyzing rapid infrastructure upgrades—new payment rails that are coalescing into a modern financial fabric across banking and capital markets. Beyond blockchain’s promise of efficiency gains in clearance and settlement; We’re moving to hyper-democratized finance, where Main Street taps Bitcoin-native capital markets and advisory services to wield Wall Street–grade tools—putting balance sheets to work and securitizing what’s next, safely. Fintech 2025 doesn’t just reinvent distribution—it rewires the factory.

Announced at/around Money20/20

Western Union: USDPT (issued by Anchorage) on Solana for cross-border remittances and treasury—enterprise-grade timelines (from 2026).

Thunes: Pay-to-Stablecoin-Wallets—direct payouts into customers’ stablecoin wallets across its global network.

FIServ: FIUSD, positioned as a bank-friendly stablecoin on Solana, with Circle + Paxos infra partners. Mastercard expects to integrate FIUSD into merchant settlement, on/off-ramps, and stablecoin-linked cards. PayPal PYUSD interoperability is in scope; Bank of North Dakota pilots (Roughrider Coin) signal public-sector curiosity.

Bitcoin native capital markets and advisory service providers are rising - Bitcoin is the new foundation of “digital capital” per Michael Saylor at Money 20/20. Blockstream’s BSTR is the newest firm entering this space of Bitcoin based Treasury Services.

TradFi ↔ DeFi connective tissue. Banks and networks are testing on-chain rails with trust, liquidity, and compliance in the middle. Beyond stables, crypto collateral in lending is gaining mindshare. Money20/20 even brought Michael Saylor—a signpost of convergence, not just coexistence.

Why this matters long-term: As finance hyper-democratizes—“Main Street gains Wall Street–grade capabilities, leveraging balance sheets and securitizing future potential in controlled ways; Fintech 2.0 doesn’t just reinvent distribution, it rewires the factory”—liquidity formation and credit intermediation shift to the edge, reshaping how shocks, incentives, and policy flow through the system. As more flows clear on programmable, 24/7 layers, policy transmission (how liquidity and credit conditions propagate) will adapt. Expect tokenized deposits, regulated stables, and programmable settlement windows to gradually influence how central banks and treasuries implement tools—not tomorrow, but that’s the arc.

Watch metrics: on-chain settlement volume with KYC’d endpoints; bank-issued/bank-integrated stablecoins in production; Bitcoin-collaterized credit and leverage (volume, LTVs);corridor count (esp. remittances); settlement time/cost deltas vs. legacy.

Stablecoin is the digital currency that rides a blockchain rail—so payments settle fast and the rules (business logic) can be coded, with add-ons like invoicing, KYC/AML checks, or automated payouts and more.

2) Programmatic money = payments that think (agentic commerce → aCommerce)

Where we are now — laying the trust layer for Agentic Commerce

Before “payments that think,” the industry is pouring concrete: a trust fabric that makes autonomous money safe, reversible when needed, and auditable.

Who’s laying foundations (illustrative):

Networks & issuers: Visa, Mastercard, Amex, Citi, Wells Fargo

Big tech & wallets: Google, PayPal

AI/platforms: Microsoft + OpenAI (with processors, acquirers, fintechs, regtechs alongside)

Visa — Trusted Agent Protocol (TAP). Merchants and AI agents authenticate each other and exchange signed instructions with auditability/recourse.

Google — A2A & AP2. Interoperable agent communications + a payments framework for agent-initiated transactions (including stablecoins/RTP) via cryptographically signed mandates. Launch partners spanned Mastercard, PayPal, Amex, Coinbase, and others.

Mastercard — Agent Pay (ecosystem signal). Parallel work to route and risk-manage agent-initiated purchases—another stitch in the same trust fabric.

Net: Great pipes, few end-to-end autonomous experiences—yet. That’s the opening. A decade after mobile unleashed a startup wave, aCommerce is the next breakout platform for innovation. Founders-now’s the time.

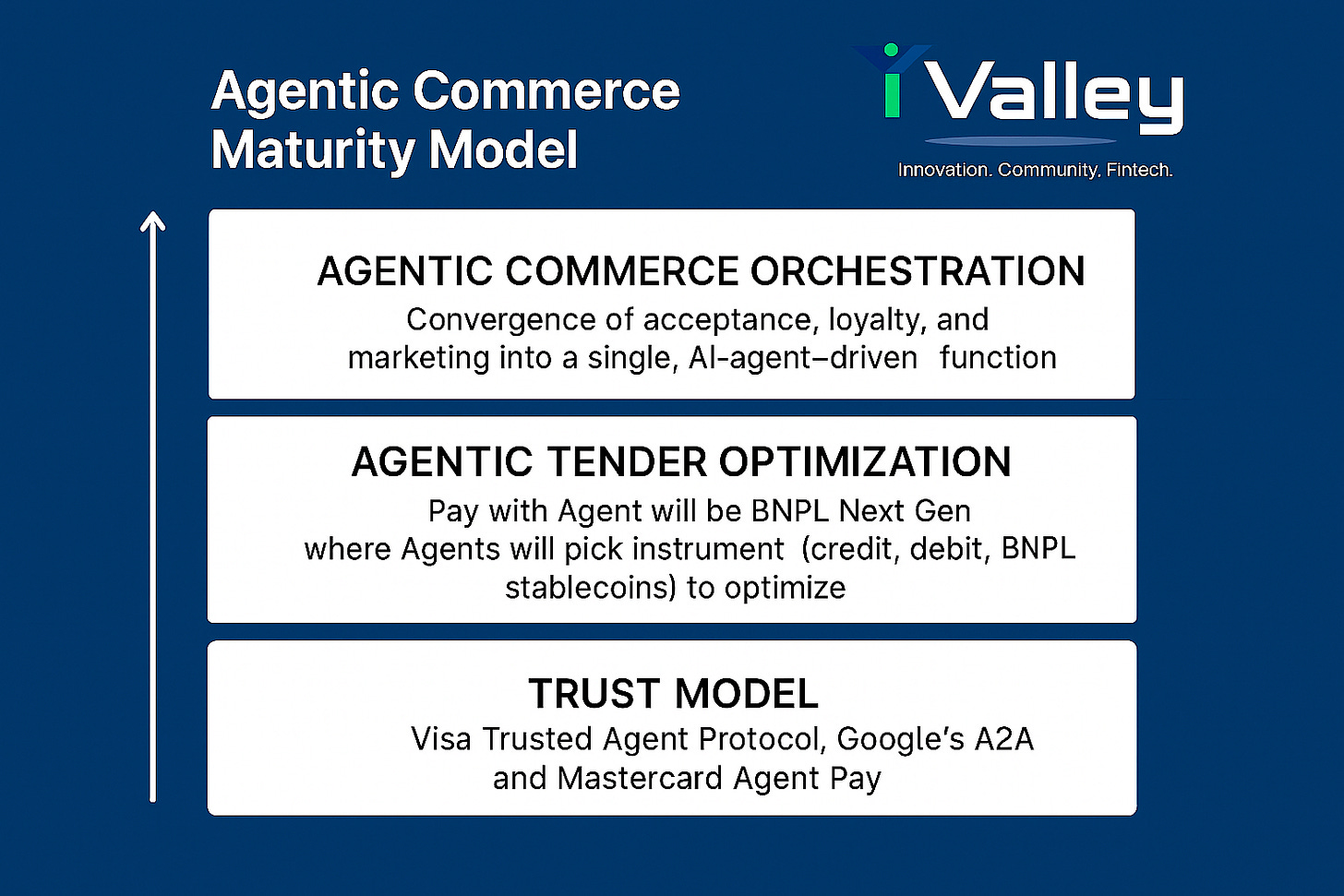

From trust → smart tender → full agentic commerce: the stack that merges payments, loyalty, and marketing.

What changes in practice

aCommerce = marketing redefined. Agents surface offers, negotiate terms, compare total cost (FX/fees), and pre-check SLAs before money moves.

PFM → action engines. Rules, not dashboards: “Sweep to HYSA,” “Pay rent by RTP if discount >X%,” “Auto-cancel dupes,” “Auto-dispute with evidence.”

Programmability at the rail. Stables + tokenized deposits enable conditional flows (escrow, splits, milestones, refund triggers) without batch-file gymnastics.

Enablers: real-time ledgers & event buses; passkeys/WebAuthn; merchant/issuer tokenization; GEO (Generative engine optimization); standardized receipts/line-item data; open-banking that triggers actions (not just views).

NEW: Agents win first in Servicing & Ops → then they disrupt software and SaaS

Where ROI shows up now. The quiet wins are in disputes, fraud, KYC remediation, onboarding, collections, and subscription cancellation—minutes shaved, basis points saved.

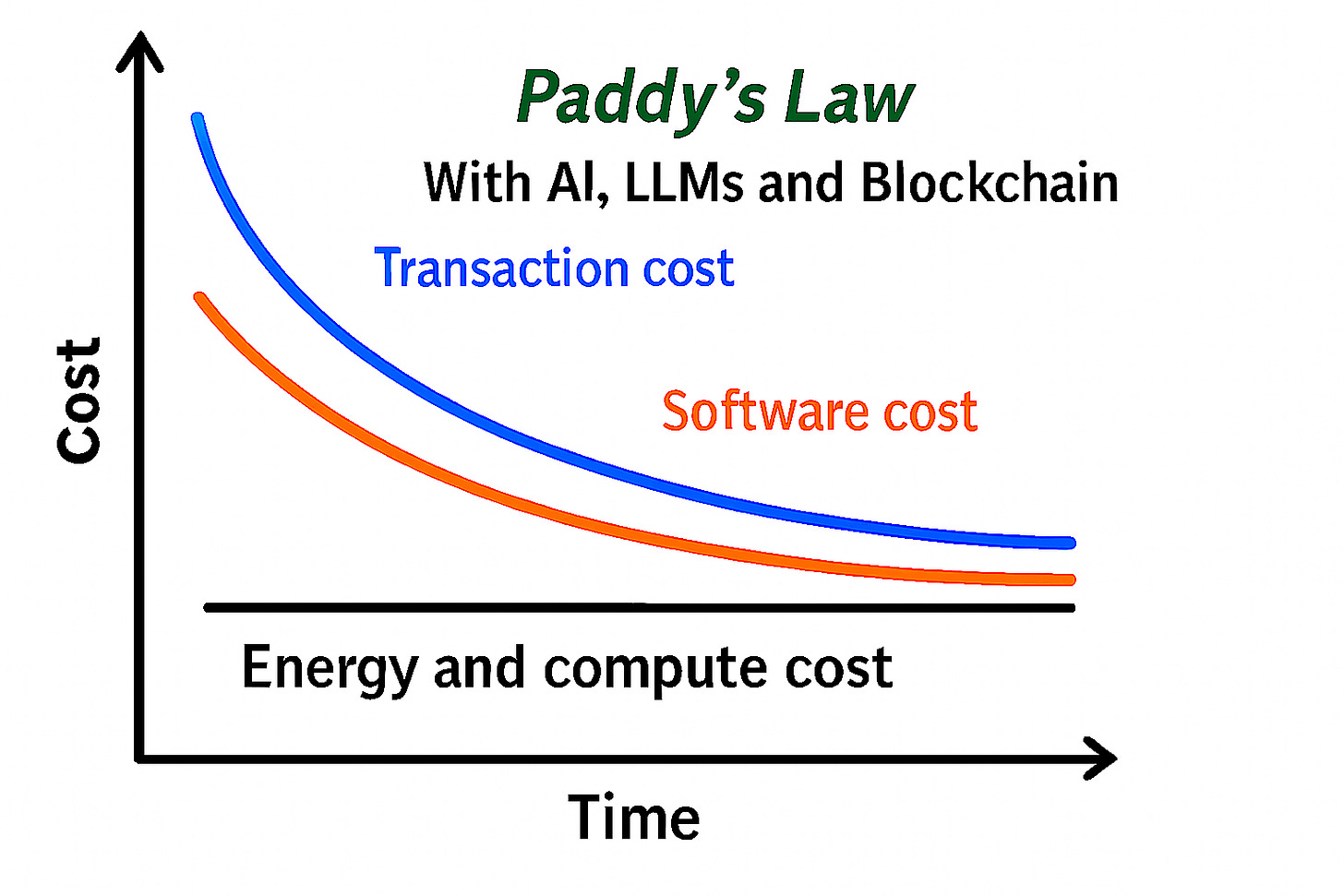

Pricing model shift. As agents take on work that used to be “human + seat-licensed app,” seat-based pricing erodes in favor of outcome-based models (e.g., Sierra-style “pay for resolved tasks or conversions”). Over time, as LLMs absorb generic capability and the marginal value of writing net-new app code falls, software pricing asymptotically converges to energy + compute.

Stack analogy.

LLMs = utilities. Foundation capacity (reasoning + knowledge) provisioned like power/water.

Agents & humanoids = appliances. Task-specific endpoints that draw from the utility and deliver outcomes (servicing, sales, ops).

Vendors compete on orchestration, data rights, safety, and guarantees—not on yet-another seat.

Implication for builders: Design contracts around SLA’d outcomes (disputes resolved, tickets closed, chargebacks deflected, ARR retained), meter by events/compute/energy, and publish verifiable proofs of agent actions.

Paddy’s Law - With AI/LLMs/Blockchain, both transaction and software costs decay, asymptoting to the underlying energy & compute cost

Money20/20 2025: Signal vs. noise

Stablecoins/crypto: edge → infrastructure. Cross-border, last-mile liquidity, and consumer UX abstraction dominated. Vibe: “don’t make users learn crypto; make the rails better.”

Agentic AI: ROI in ops & service. Flashy demos aside, measurable wins landed in back-office flows.

Embedded finance/BNPL: from launch hype to durable economics. Less “spin up a card,” more governance, partner roles, and margin math.

Everyday commerce + loyalty moved closer to the rails (e.g., Venmo × Bilt).

dLocal BNPL Fuse: cross-country, API-first credit at checkout for under-credentialed consumers—flexibility as inclusion lever.

Agentic AI inside flows (onboarding, disputes, collections) delivering measurable service outcomes.

Trust, safety, and data standards are the chokepoint. Interoperability + usable data beat shiny features.

Mastercard Threat Intelligence × Recorded Future: payments telemetry fused with cyber intel—fraud + cyber as one discipline.

Behind closed doors: standards for AI safety baselines, on-chain interoperability, and data schemas that make agents dependable.

What to build next (playbook for banks & fintechs)

Near term (0–6 months)

Ship real-time ledger + instant alerts ; automate disputes

Pilot stablecoin corridors where compliant (clean KYC/KYB, upfront FX, transparent status).

Embed agentic ops in high-ROI pockets: KYC remediation, dispute intake, collections, subscription cancellation.

Mid term (6–18 months)

Launch agentic-commerce trials: intent capture → offer negotiation → programmatic settlement(escrow/splits/conditions).

Roll out stablecoin ↔ tokenized deposit interoperability with strong controls; measure speed/cost vs. legacy.

Standardize receipt/line-item data; turn PFM into actionable automation (sweeps, sequencing, guardrails).

Trial Agentic and Autonomous Banking.

Foundational rails

Identity Fabric: device binding + passkeys/WebAuthn; risk-based step-ups; auditable consent and delegated authorization.

Networks & Governance: private and public networks with enforceable guardrails—KYC/KYB, permissioning, provable compliance/attestations, interoperability standards, settlement finality, and upgrade paths.

Data spine: clean schemas, event streams, feature flags, and model governance/explainability.

Agentic Rails (trust + flexibility) - Agent identity & scopes, Verifiable mandates & proofs, Observability & audit

Bottom line

We’ve crossed from pilots to production-grade infrastructure: stablecoins and tokenized value are wiring into real rails, while AI agents begin to collapse the gap between intent and settlement. Policy clarity accelerates the shift on-chain. In parallel, agentic ops pressure seat-based pricing and pull the industry toward outcome-metered contracts, eventually pricing software on energy + compute. Do the standards, safety, and shared data models right, and money becomes programmable end-to-end—discovery → decision → payment → fulfillment → service—running on trusted, real-time rails. That’s the arc; today’s upgrades become tomorrow’s operating system for finance.

Paddy Ramanathan

Founder of iValley and Host of the FINTECHTALK™ Show (Substack, Apple Podcasts, YouTube, Spotify)

Interested in sponsorships and helping sculpt the future? fintechtalk@substack.com

Thanks to ChatGPT, and Akshatha Shetty for suggestions.