The real reasons for the collapse of SVB (and potentially the prominence of S.F Bay area) and and the rise of the global digital bank for startups

Fed's QE followed by higher interest rates, lack of interest rate hedging and standard accounting practices and groupthink gone awry.

This is a fast-changing story. Here are are some updates as of Tuesday, March 14th: For the original article, scroll below

The story behind the story (not financial advice) on the SVB and Banking situation

✅ The Fed, Treasury, and FDIC, through a joint statement before markets opened in Asia (around 315 pm pacific on Sunday ) announced several measures to protect depositors at SVB and Signature Bank (two failed banks) and create a Bank Term Funding Program (BTFP) for any US Bank to borrow at par from any securities in their balance sheet that has decreased in value due to high-interest rates.

✅ 𝗛𝗼𝘄 𝗶𝘀 𝘁𝗵𝗲 𝗗𝗲𝗽𝗼𝘀𝗶𝘁𝘀 𝗯𝗲𝗶𝗻𝗴 𝗴𝘂𝗮𝗿𝗮𝗻𝘁𝗲𝗲𝗱, 𝙬𝙝𝙚𝙧𝙚 𝙞𝙨 𝙩𝙝𝙚 𝙢𝙤𝙣𝙚𝙮 𝙘𝙤𝙢𝙞𝙣𝙜 𝙛𝙧𝙤𝙢

- By claiming SVB and Singnature banks as Systemic risk, FDIC is covering all the deposits through additional premiums from all banks. Essentially, any loss of deposits by SVB is made whole by sharing it across all depository institutions (some that would recover it from their depositors). Kind of a hidden, backtax in form of forced premiums for Banks (and indirectly to Bank customers) which could make a good legal debate on constitutionality as some could argue Congress needs to approve such direct or indirect taxation.

✅ This intervention seems to have calmed the broader markets, domestic and international but certain Banks esp regionals in the US like FRC, WAL, and PACW are significantly down in Monday trading besides reassurances from those Banks and the Fed/Treasurys action

✅ 𝗧𝗵𝗲𝗿𝗲 𝗶𝘀 𝗮 𝗽𝗲𝗿𝗰𝗲𝗽𝘁𝗶𝗼𝗻 𝗮𝗻𝗱 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗺𝗼𝗱𝗲𝗹 𝗽𝗿𝗼𝗯𝗹𝗲𝗺 𝗳𝗼𝗿 𝘀𝗼𝗺𝗲 𝗼𝗳 𝘁𝗵𝗲𝘀𝗲 𝗯𝗮𝗻𝗸𝘀 - More than just the numbers, I think there is a business model and perception problem. SVB (and some of the other banks) served as a "VCs Bank" that depended on recycling the venture capital that came to it in form of deposits to offer venture debt (usually without cash generation or guarantees like typical debt) consequently creating higher valuations for startups (then supported by cashflows). This was backstopped by liquidity events like IPO or M&A so the cycle would go on. No liquidity events for the last several months and nothing in the horizon has essentially crippled the model.

✅ 𝗧𝗵𝗲 𝗕𝗮𝗻𝗸 𝗧𝗲𝗿𝗺 𝗙𝘂𝗻𝗱𝗶𝗻𝗴 𝗣𝗿𝗼𝗴𝗿𝗮𝗺 (𝗕𝗧𝗙𝗣) 𝗰𝗮𝗻 𝗰𝗮𝘂𝘀𝗲 𝗶𝗻𝗳𝗹𝗮𝘁𝗶𝗼𝗻𝗮𝗿𝘆 𝗽𝗿𝗲𝘀𝘀𝘂𝗿𝗲 - announced by the Fed allows Banks and depository institutions to get 1 year loans by pledging US Treasuries and some other instruments that have gone down in value at par value. My estimate is that this could create the need for about $1 Trillion for the Fed which will likely be possible only through QE. This will likely result in more inflationary pressure, rise in commodity prices (see BTC price movement point below) and fundamentally would need drastic reduction in government spend in a year to control it from having a spiralling effect.

✅ 𝐁𝐓𝐂 𝐡𝐚𝐬 𝐠𝐨𝐧𝐞 𝐮𝐩 𝐚𝐛𝐨𝐮𝐭 𝟏𝟓-𝟐𝟎% since the announcement yesterday indicating some are seeing the announcement as more downward pressure on the Dollar

Ken Griffin of Citadel calls the SVB Bailout as “US capitalism breaking down before our yes” and “moral hazard” in an FT article.

https://www.ft.com/content/aeb9ef58-6fc1-45af-88b2-b46a2a532b3f

BTC-USD continues to rise as of Tuesday morning, markets treating BFTP program by Federal reserve as dilutive to USD impacting all tax-payers and USD positions not just SVB related enitities.

The Original article published on Sunday

Silicon Valley Bank (SVB), a prominent commercial bank for startups, recently faced a catastrophic collapse. On Friday, the bank was unable to control a massive run on its deposits and failed to raise the necessary capital to survive. As a result, the bank was shut down by California regulators, and the FDIC took over its receivership. This news has been widely discussed in both traditional and social media, including by myself.

In this article, I will explore the factors that led to SVB's collapse, why this event serves as a wake-up call for various stakeholders and my forecast that a global digital bank for startups will emerge from the ashes.

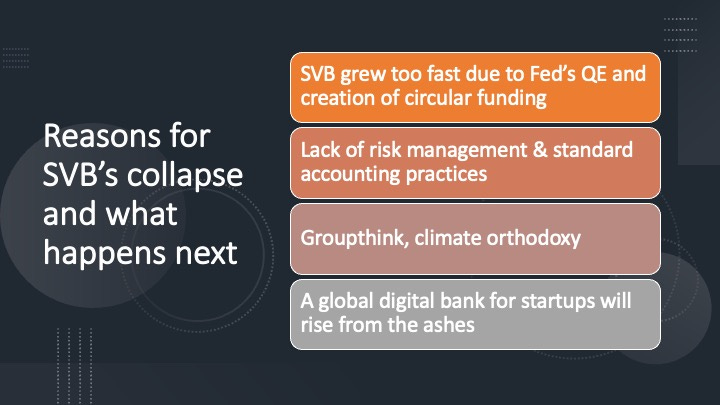

SVB's collapse was not an overnight event but rather a result of a series of missteps over time, summarized in the infograph below. Besides failures of risk management and accounting missteps, some larger forces were at play like Fed’s QE, the creation of circular funding, and higher interest rate environment partly due to foreign policies, groupthink, and climate orthodoxy.

SVB grew too fast, largely due to the Fed’s QE, and there was a circular movement of the money from fed to banks to VCs to startups to SVB and back to Fed.

The total deposit of SVB nearly doubled in 2021 to $147 billion, primarily due to the surge in startup funding resulting from the Federal Reserve's injection of excess liquidity (see chart below of total assets held at the Federal Reserve, which shows an injection of almost $9 Trillion compared to about $2 Trillion during the 2008 crisis). SVB’s loan portfolio grew only at about half that pace compared to its deposit growth leaving SVB with extra cash, which it turned around and bought long-term treasuries (more hold-to-maturity (HTM) security without any rate hedges). See the table below for figures from their balance sheet.

Source: ycharts.com

The Fed bought Bank securities and created more liquidity in 2020/21. Banks like SVB lend this extra money to VCs and others that invested in Startups who brought those investments into their SVB accounts. When SVB’s deposits grew, it turned around and bought U.S Treasuries (without hedging for interest rate risk), completing the full loop for circular funding. SVB’s CEO Greg Becker was part of the San Francisco Federal Reserve’s board of directors since 2019 up until Friday, he was removed after the Bank’s collapse.

Source: SVB financial statements. Interestingly in SVB’s financial statement, the % change of 342.50% from 2020 to 2021 HTM securities was indicated by a NM

Under the Basel III framework, there is no limit to U.S Treasury securities that Banks can hold, but there are usually concentration limits under internal policies and regulatory guidelines that limit exposure to any one issuer or asset class. It is unclear if this was flagged during any SVB’s balance sheet examination for portfolio diversification, market risk considerations, and liquidity risk management.

Additionally, the circular loop of money, which, if more prevalent than at SVB, could have more serious implications and consequences for the U.S. banking system and economy.

Interest rate hedging, more than normal classification as HTM(hold till maturity) over AFS(available for sale) - basics of risk management and standard accounting was not practiced at SVB

In the lead-up to the collapse, the SVB team made a valiant effort to capitalize their shrinking capital base. Here is their Mid-quarter strategic actions update, where they decided to sell a good portion of their AFS Securities at about $1.8 Billion loss (due to a higher interest rate environment, SVB’s bond portfolio had decreased in market value significantly), and their plans to hedge the AFS portfolio with receive floating swaps. This should have been done earlier in 2020/21 when they were buying these securities; it is unclear why it was not done. Perhaps the team did not have the experience or model of the interest rate risk. SVB perhaps did not anticipate a sustained higher interest environment like now which is likely due to the support for the war in Ukraine. Additionally, SVB chose to classify a significant portion of its bond portfolio as HTM to possibly avoid the mark-to-market losses on securities on capital. The 2022 HTM/AFS is almost three times, with HTM at 95 Billion is even greater than their loan assets. This decision boxed SVB significantly, limiting its transactional liquidity and operational flexibility. HTM classification has limited upside as regulators and investors can analyze the losses of HTM securities through financial statements and call reports. Most institutions use modest classifications as HTM.

Several business accounts at SVB of startups kept an uninsured balance of over $250,000. This was part of the closed-loop model of SVB, essentially creating more leverage. I was talking to a boutique venture debt firm yesterday, and the partner was saying that SVB would underprice deals on a regular basis. This was likely possible only due to lower cost of capital with the closed-loop model of keeping all the startup deposit amounts within SVB.

In retrospect, SVB's risk management was subpar and will be talked about and make it in to finance case studies in schools for years to come.

Groupthink, Climate orthodoxy in the SF bay area at large is slowly eating away its greatness - not readily visible unless you peek at company cultures.

The current state of affairs in the Bay Area is concerning, with the collapse of SVB, in the heals of FTX and Silvergate Bank, Big Tech layoffs, and a high vacancy rate in downtown San Francisco. Some reports suggest that the vacancy rate is as high as 27%, likely higher.

What is causing this downturn? I believe that pervasive groupthink is a major factor. People are entrenched in their beliefs, and there are far too few debates of ideas. We need strong debates to make good decisions and judgments rather than blindly following the right, left, or middle. Without this critical thinking, the Bay Area risks losing its position as a hub of innovation and progress. Climate orthodoxy is deviating attention and resources from priorities of basic infrastructure and common sense investments.

It's time for the Bay Area to wake up and recognize the importance of open debate and diverse viewpoints that made it great over the last 50 years. We can't afford to let group thinking stifle creativity and progress. It must come together, embrace new ideas, challenge old assumptions, and drive innovation. Only then can we ensure that the Bay Area remains a beacon of progress and prosperity for years to come.

What happens now…

A lot of movement over the weekend with several folks trying to be creative to get deposit access to the account holders. FDIC has published its next steps here. It says the depositors will have full access to insured deposits ($250,000) on Monday and receive a receivership certificate for the remaining uninsured deposits. The date and terms on which the receivership certificate can be encashed are unclear, but it appears to depend on the liquidation of the SVB’s assets. Early estimates are that depositors would get 80 to 90 cents to the dollar of their uninsured deposits and perhaps the whole amount if backed by taxpayers.

There may be other creative avenues for depositors, and various efforts are underway. Mike Cagney (CEO of Figure) is looking to stand up a marketplace for deposit receipts on the Provenance blockchain platform, some information here. According to TechCrunh, CEO of Brex, Henrique Dubugras is trying to raise bridge capital for the depositors. Various hedge funds are looking into buying SVB assets at discounts. VCs and local Congressman are openly lobbying on social media for SVB to be acquired by a well capitalized institution and deposits made whole, arguing that if the Fed does not step in and orchestrate the buyout there maybe more run on the bank esp. of regional Banks with similar exposure. This week will be interesting.

A global startup digital bank will rise out of the ashes of SVB

Silicon Valley Bank (SVB) has been a crucial player in the startup and venture capital ecosystem of Silicon Valley. However, the influence of startups and venture capital has expanded beyond Silicon Valley and become a global phenomenon. During my recent visits to India and Dubai, I had the opportunity to meet with local VCs and startups, and was impressed by their numbers and ambition.

In Bangalore, the leading startup hub in India, one prominent local VC revealed that they see around 800 startups a month, a number that exceeds Silicon Valley standards. Meanwhile, the DIFC Innovation Hub in Dubai houses over 730 startups and has ambitious plans to develop local unicorns and scaleups this decade. This trend extends to other regions, such as Riyadh, Eastern and Southeast Asia, Latin America, and Africa.

Startups and venture capital are critical cogs in the growth of economies and nations and for catalyzing upward mobility in societies. The next generation of startup banks and ecosystems will not be a closed-loop model like SVB’s nor will it be hyper-localized. I predict that a global digital bank for startups will rise out of the ashes of SVB. This new bank will leverage the latest technologies, such as blockchain and artificial intelligence, to provide innovative and cost-effective banking solutions to startups worldwide. The bank will prioritize risk management and stability while offering a range of financing options to meet the unique needs of startups. It will spread risk and reward, enabling under-represented founders.

iValley was already working with large global financial institutions, as part of its iValley Global initiative, on a global digital bank for startups before the SVB collapse. A distribution and an ecosystem play with local bank partnerships to promote indigenous startups and VCs. Elon Musk tweeted yesterday that Twitter may be interested in purchasing SVB to build something similar. It is always great to have Mr. Musk as a competition :). More on iValley Global and how you can engage on these pages soon.

Quoting and slightly paraphrasing (for current context) the great poet Alfred Tennyson:

“The old order changeth, yielding place to new, And people fulfil themselves in many ways, Lest one good custom should corrupt the world. Comfort thyself: what comfort is in taxpayers and FDIC?”

Paddy Ramanathan

Founder of iValley (www.ivalley.co) and

Host of the FINTECHTALK™ Show

Thanks to Chatgpt for the suggestions.