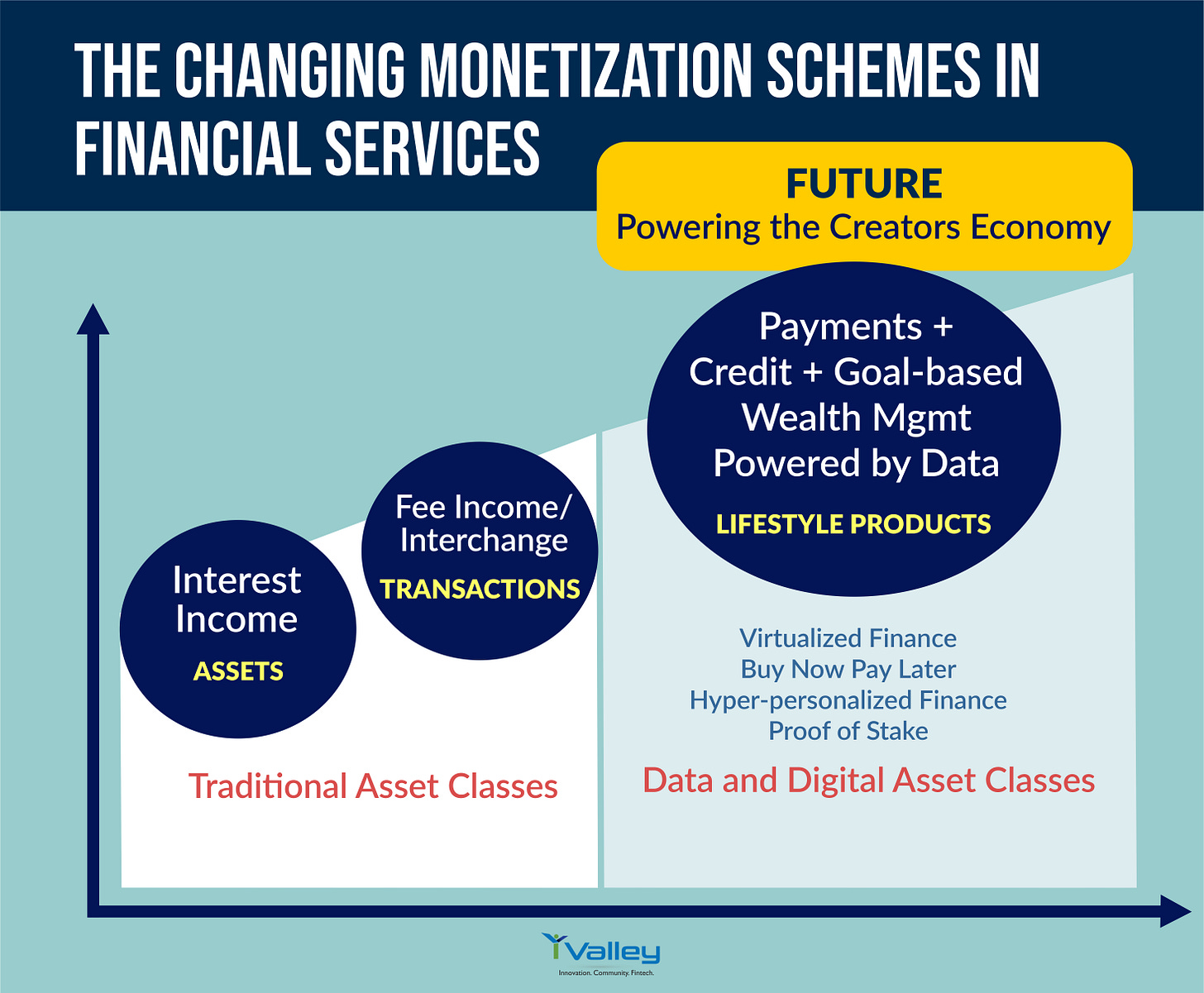

The Changing Monetization Models in Financial Services

Data as a new asset class and the Creators economy will bring Banks' Business Models to compete with internet firms

HI FINTECHTALKERS,

I sat down with some of the leading minds in customer engagement in financial services, monetization of data, and privacy: Gerti Dervishi, Chief Growth Officer at Flybits, Yoav Finkelshtein, Co-founder at QPrivacy, Scott Paterson, Founder and Executive Chairman at FutureVault, Rockwell Clancy, Financial Services Expert formerly with JD Power to talk about the changing landscape of data, privacy and business models in financial services. This edition of eFINTECHTALK includes a recap of that conversation by the Fintech Elder and our standard editorial infograph in addition to:

Upcoming all-star FINTECHTALKs show schedule. Sheel Mohnot, Ryan Patel, Shamir Karakal, and more - Save to calendars now.

Announcing the Crypto Economy report from iValley (only for subscribing members) - a comprehensive report of the opportunity, projects, and regulatory landscape. Become a paid subscriber now to always be in the Know. Check out the preview of the Table of contents

Data and forms of Crypto are becoming new asset classes unleashing the Creators economy where Customers will be more in control. Banking Business models will evolve from traditional asset and transaction revenue models to monetization of data and stake. Read more on the recap and epilogue below.

iValley is a 3rd generation startup factory, sculpting the future of fintech and crypto-economy. To join iValley click here.

Enjoy and always Be in the Know

Paddy Ramanathan

Founder of iValley (www.ivalley.co) and

Host of the FINTECHTALK™ Show

(http://www.fintechtalk.co)

FINTECHTALK Special Edition - With Ryan and Sheel

29 September, Wed | 12: 00 PM PDT

Featuring:

Sheel Mohnot, Co-founder/GP at Better Tomorrow Ventures (formerly founder of 500Startups)

Ryan Patel, world-renowned go-to authority on global business, political economy, and corporate governance. CNN Contributor

FINTECHTALK Special Edition - With Shamir Karakal

13 October, Wed | 12: 00 PM PDT

Featuring:

Shamir Karkal - formerly Co-founder of Simple - the original challenger bank and now Co-founder and CEO of silaMoney - Shamir is the quintessential fintech founder who is always ahead of the time

iValley’s Report: Crypto Economy

and Web 3.0

iValley’s research report on the status of the Crypto Economy and Web 3.0 is a must-read for anyone who has interest from investors, to founders and everyone in between.

This comprehensive report gives readers insights Defi, Decentralized Web and how Crypto will fundamentally change the fabric of the internet as a business model. How will the Creators economy unfold and what role can you play in it.

This is a must-read for everyone who wants a sneak peek into the future of the Web.

Subscribe to our Substack to reserve your copy! (This report is only available for paid subscribers)

4 Things Fintech Customers Absolutely Want

The Fintech Elder recap of the Customer Engagement Imperative in Financial Services Show.

Fintech Elder is an advocate for unreasonable customers

While we carry on with our love fest about Fintech and venture capital, another powerful Category 5 hurricane has been forming right next to you.

Let’s admit it. Customers thus far have been treated as sources of revenue, nothing more. Once in a while, we claim that “the customer is number one!”, shed a few tears and then get back to the business of making money. In fact, the customer has thus far been quite used to be being humored at best, and has allowed businesses to push and prod him to squeeze out the last dime.

Not any more.

The new customer – I’ll call him Version 2.0 – is demanding and sophisticated and couldn’t care less about your brand and what you have to offer.

Financial Institutions have not really evolved a great deal over the past 200 years, with customer orientation increasing only marginally. But now we have Fintechs that have enabled a huge shift in focus to customer experience and engagement, particularly with the arrival of tech-savvy millennials.

I sat quietly in the digital shadows and listened in to a very interesting session titled “Customer Engagement Imperative” on August 26 on Clubhouse.

Hosted by the affable Paddy Ramanathan, CEO of iValley, who is getting quite a name for his networking abilities, the panel had several heavy hitters.

Gerti Dervishi, Chief Growth Officer at Flybits

Yoav Finkelshtein, Co-founder at QPrivacy

Scott Paterson, Founder and Executive Chairman at FutureVault

Rockwell Clancy, Financial Services Expert formerly with JD Power

Unlike my earlier reports where I traced the flow of discussions, this time I’ll get straight to the point. So let’s see what we heard the panelists say on behalf of customers.

01

“I want Digital Freedom”

Customers had been handing over enormous amounts of data across multiple channels without even realizing that their privacy was being compromised. Now that they realize it, they want digital freedom while being sure of privacy. It may be true that data is being converted to customer experiences, but there is a need to assure them privacy layers are also being introduced. Gerti and Yoav made persuasive observations about this important demand.

Did you know that the moment you open a bank account somewhere, Facebook and Google know about it too? Are you prepared to be exposed in this manner? Customers want to be able to control what they want to share.

02

“My Experience is more important than your product.”

Banks and financial institutions are bending over backward to create fancy products and services. But often there is a lack of visible integration. The customer is asked to hand over the same data at different places for different needs. There are so many technology partners surrounding financial institutions that you wonder why hyper-personalization and contextualization aren’t smoother, given that customer data is the same.

Scott felt that the customer is going to demand a digital vault which those using his data must populate. This would then shorten transactions and reduces errors. The customer wants frivolous repeated activities that he has already done to be eliminated subsequently. This is a critical part of his experience and shortens the route to product use.

03

“Analyze what I’m doing rather than ask me for my opinion.”

Consumers are surveyed constantly, and efforts are made to find out how happy they are. But it’s rare to check the behavior that led to the response. This next-level of involvement in the customer is the best way to eliminate experience hiccups, observed Rockwell. Let’s find out what the customer is doing that made her really happy or really unhappy. The clues to enhanced experience lie there. These clues can be found in the enormous amounts of data lying untouched in various silos across banks.

04

“I deserve security and privacy and should also have the right to monetize it.”

Privacy is a human right, said Yoav. The fact that technologies can be intrusive needs to be tackled. And further, if you, Mr. Tech company, want to use my data to further your business interests, please pay me for it. Thus says the newly assertive customer.

In the end, all this is going to make the customer king, but in a whole different way. It is for financial institutions to navigate through the maze of regulations and find ways to serve the customer with hyper-personalized products and services while becoming more sophisticated about privacy issues.

I like Customer Version 2.0. Bigger, better, more tech-savvy. The ultimate catalyst for better Fintech solutions!

The Fintech Elder is glad the tide is turning in the customer’s favor.

EPILOGUE

To join iValley as it sculpts (build, write, and talk) the future of fintech and crypto economy - click here.

Breakthroughs in Driving Engagement and Sales via Digital Channels | 25 August

If you missed our live show, here is the recorded version!

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd, E-909

San Ramon, CA 94582,

The United States.

Phone: +1 925-575-7832