The Crypto Economy Tales

It's just not financial services silly, it's the internet as a business model. A surreal expose of what the future of the Crypto Economy will mean to you.

Hi FINTECHTALKERS,

Cryptos have been in the news lately (you don’t say). While Elon Musk’s sudden enlightenment of high school Thermodynamics (which we know now was from Larry Fink of Blackrock - and how I would have loved to be a fly on the wall during that conversation), has taken much of the Oxygen, few people are focussing on the bigger picture - What is the Future of the Crypto Economy .

I sat down on Clubhouse to discuss just that with Surojit Chatterjee (Chief Product Officer at Coinbase), Mehul (Mike) Patel of EDDASwap and David Putts of the Billon Group last week and the conversation has been succinctly captured by the Fintech Elder and is included in this edition below with our standard editorial epilogue infographic.

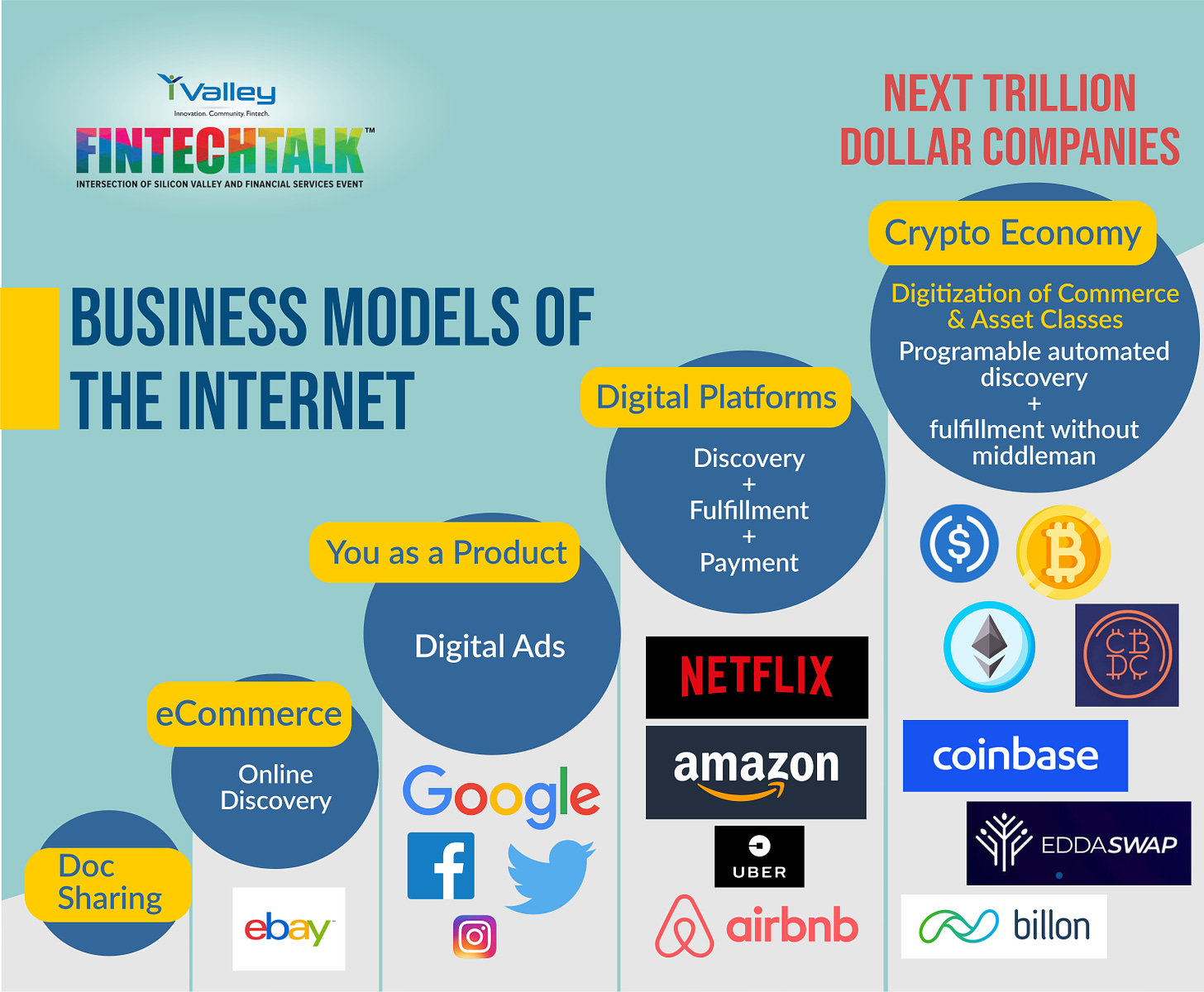

While there is a lot of talk and some understanding of how Crypto will change the financial services factory, and how Bitcoin can be digital gold, what is not well understood is that Crypto and Blockchain are foundational technologies that will shape the business model of the internet including the current business of search, social media (Google, Facebook etc) and platform businesses (Uber, Amazon, AirBnB etc).

The internet user (you) as a product has worked well for Google, Facebook and other internet firms but crypto technologies like NFT will enable web users or creators to monetize their contributions eating into the share of Google, Facebook etc. Imagine a ride service without a central party like Uber that is based on smart contracts is a real possibility now only this time it will be for all types of services distributed on the internet - eCommerce will become cCommerce or tCommerce or Crypto or Tokenized Commerce - programmers, artists, writers, video bloggers, drivers, and others not having to depend on platforms like Youtube(and others) and its algorithm to monetize and benefit from the massive distribution potential of the Internet.

The TAM for the Crypto-Economy includes changing economics in Banking and Financial Services (interchange, settlement and clearing efficiencies, new asset management fees, insurance or risk premiums) but also the search, social media, and shared economy “middleman” revenue. The latter is largely unregulated and presents the trillion-dollar opportunity for entrepreneurs, creators, and the average internet user (you) to capture with crypto native business models. The good news - you don’t have to be an insider to monetize and succeed.

The promise of the Crypto economy is to democratize the Internet’s monetization models

Also in this edition, details about a couple of exciting shows coming up on FINTECHTALK™. Join me on May 26th for the future of Wealth management and on June 9th on Platformization of Financial Services - what’s next - both with an all-star panel. See links below for details and how to save on your calendar for easy reminders.

To join iValley, a 3rd generation startup factory, click here.

Enjoy and always Be in the Know,

Paddy Ramanathan

Table of Co̶n̶t̶e̶n̶t̶s̶ Future in this Edition

The Future of wealth-management in the era of digital assets and crypto - Save to calendar -> May 26th at 12 pm PDT - With Fidelity and others

Open Banking 2.0 - Platformization of Financial Services - What’s next - Save to Calendar -> June 9th at 12 pm PDT - With Synctera, Moov, DXC and others.

The FINTECH ELDER recap of FINTECHTALK Show on May 12th - The future of the Crypto economy.

Upcoming FINTECHTALK™ Shows

May 26, 12 PM PDT

The Future of Wealth Management in the Era of Digital Assets with Fidelity and others

Listen to Nancy Tengler (Best selling author, Financial Columnist @ USA Today, Frequent Guest on CNBC, Fox Business, and Bloomberg TV), Alessandro (Ale) Vigilante (Fidelity Investments) and the others talk about the future of wealth management.

June 9, 12 PM PDT

Open Banking 2.0 - What’s Next in the Platformization of Financial Services?

Listen to Peter Hazlehurst, Co-Founder, and CEO at Synctera, Wade Arnold, CEO at Moov Financial, Eric Purdum General Manager at DXC Technology talk about what is next in the platformization of financial services.

Show schedule at www.fintechtalk.co, DM us on @iValleyIC if you’d like to come on the show!

The Crypto Tales

Recap of May 12th FINTECHTALK Show on the Future of Crypto Economy by the FINTECH ELDER

Did you ever feel you lived in a Matrix?

Nothing seemed real. Everything was disconnected. We were disembodied. Just digital entities, floating in the ether.

I had that eerie feeling when I listened in (from the digital shadows, of course) to an extraordinary debate on what the Crypto Economy really means.

Moderated by the affable Paddy Ramanathan, Founder of iValley, this particular FINTECHTALK Show on Clubhouse on May 12th had three High Priests of the emerging Crypto religion take a rapt audience through 90 absorbing minutes.

The Beginning of Unlearning

Understand this – everything you knew about money, transactions, and banks is about to be thrown out of the window (of the matrix). Prepare for it.

Empowerment of the Unbanked

The effervescent and opinionated Mehul Shah, CEO of EDDASwap spoke about how the crypto economy has had the effect of reaching out to a huge unbanked segment at the bottom of the pyramid, which traditionally had no access to banks or lacked the ability to buy gold or silver.

Tokenization of Assets

David Putts, Chief Growth Officer of the Billion Group, concurred, pointing out that it provided a safe haven to much less fortunate. But in a less glamorous manner, the crypto way has helped by providing a digital platform to streamline many processes. The SWIFT network still involved more than a dozen separate processes and there is no insight into when actual reconciliation might take place. Crypto solves that beautifully. And in parallel, the tokenization of assets – whether physical or digital – will have a massive impact.

The regulatory world is trying to catch up. But if crypto allows you to be your own bank, where does it leave revered old financial institutions? Those are deep thoughts!

Unbanking the Banked

The phenomenon of Coinbase replacing TikTok was a gratifying moment for Surojit Chatterjee, Chief Product Officer of Coinbase. In his opinion, growing interest in crypto would help the financial system more efficiently by reducing costs and intermediaries. It would allow people to take their financial destiny into their own hands.

That made me pause. He was right. At this moment, we depend on financial institutions completely and have little independence in financial decision-making. Would crypto address that? Pretty cool!

Non-Fungible Tokens

Mehul turned up the heat by explaining how NFTs (Non-Fungible Tokens) would have a revolutionary impact. NFTs provide Proof of Authenticity to physical (art, baseball cards etc.) and digital assets, which Bitcoins are unable to because they are immutable. NFTs will create a revolution in the way things are sold in the market. New business models are certain to emerge.

What would been have the fate of Napster if NFTs were present 20 years ago? You tell me!

This then marks our formal merging with the matrix. We will be able to create tokens for people – even for tweets. Royalty will go to the actual creator instead of enabling platforms. Will Google have to pay when we use it to search for anything? The mind boggles.

Thus spake the crypto-prophet David: “The future is identity. We can now control our identity. We give up our identity so freely when we hit “I accept” without a thought. Verily, I say that you are a product and you ought to be able to monetize yourself.”

Get the picture?

Crypto and Traditional Banks

Of course, there are immediate challenges that need to be addressed. For example, how do we make the bridge between crypto and traditional banks? Will crypto be embedded in the banking system?

Much depends upon regulation, observed Surojit. Bitcoin rails can make the connection. Some countries can convert their currencies to digital currencies. Over time, regulations also start integrating sovereign currencies into the infrastructure.

I think he’s right. Banks will have no option.

David mused that an important challenge for crypto regulation was Anti-money laundering. It would be important to verify the source of the assets – banks show the information to whosoever needs it. Every day people should be approved to use the assets as they are not doing anything bad. Regular customers still needed technology for small issues, like premium adjustments; there was potential for a fifty percent saving in costs. All this was paving the way, he said, for cryptocurrencies that leveraged sovereign currencies,

I thought that was fair, though Surojit did point out that the preferred vehicle for money laundering was still cash. It followed that digitizing money would have an impact. Mehul disagreed and felt that banks had participated in money laundering and connived over corruption. They had created a permanent void.

On Paddy’s prompting, the panel mused over the next big innovation beyond changing business models, you as a product, NFTs, unbanking the banked, regulatory issues, and such.

A couple of points emerged:

1. Social currency would be the next big thing. A bridge between CS and DeFi is important. Tokenization would be unstoppable.

2. The financial world will be completely deconstructed as governments will take crypto very seriously.. Fin 101 will be reimagined. This deconstruction would go beyond the value chain and we would see decentralized Uber-like applications on the blockchain.

Lady Gaga and her NFTs

The real breakthrough, and what makes blockchain so amazing, said David, is the “Unification” of asset classes – money, identity, and data. People do want to monetize their identity/data as they become more and more aware. Crypto is only a piece of the overall puzzle.

“Will Lady Gaga start her new NFTs? “

We were left with this piercing question.

Do you have an answer?

My haiku from way beyond, which I know you’ll love.

A matrix token

A soft digital summer

Crypto Currency

From the desk of The Fintech Elder, now tokenized and monetized, watching the world from the digital shadows. No one knows who I am.

EPILOGUE

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd, E-909

San Ramon, CA 94582,

United States.

Phone: +1 925-575-7832