The Future of WealthTech & upcoming 🔥🚀 BaaS/Embedded finance show this Wed

Fintech elder's recap of the Clubhouse talk on the future of Wealth Management and details about the upcoming show on Banking as a Service, Embedded Finance and Community Fintech - Wed at 12 pm PDT

Hi FINTECHTALKERS,

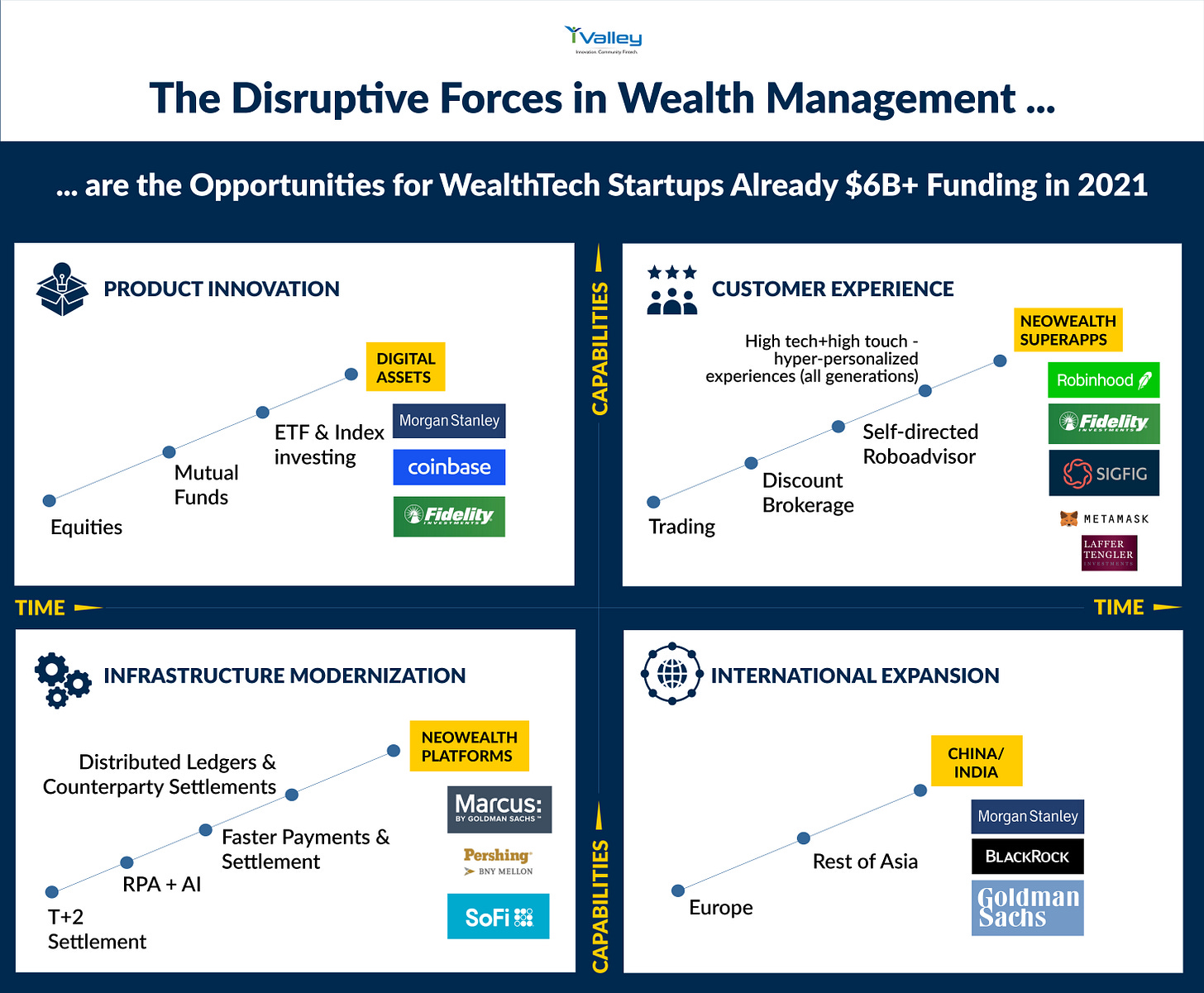

The business of wealth management is undergoing seismic changes. I sat down on Clubhouse with leaders from Morgan Stanley, Fidelity, and Laffler Tengler Investment management to talk about the forces and where the biggest innovation opportunities are for incumbents and entrants. The Fintech elder has succinctly captured the conversation below (Did you know Wealth Managers are looking for you? Yes, you!) and our standard editorial epilogue infographic is a must-glance below.

The Future -> hyper-personalized neoWealth super-apps with high human touch and an efficient, crypto-capable, and fast clearing neoWealth platforms. And more new wealth creation in the East.

Talking about platforms, I am really looking forward to hosting the great Wade Arnold 🔥🚀 (CEO of Moov - the largest fintech community ), the wonderful Peter Hazlehurst 🔥🚀 (fresh from $33 Million funding round CEO of Synctera), and the extraordinary Eric Purdum 🔥🚀 (former navy diver and now GM of DXC’s Banking and Financial Services business). We will be also joined by Synctera customer Howard Klein 🔥🚀 of CFSB - a high-tech + high-touch Bank.

Moov and Synctera are soon-to-be fintech unicorns realizing the value of Banking as a Service, Embedded finance esp. from Main Street businesses (The powerhouse of American economy - the small business enterprise).

DXC with its partners Temenos, Microsoft is helping financial institutions, large and small, innovate, digitally transform front and back-office.

Please join us this Wednesday at 12 pm Pacific on Clubhouse - save to your calendar link here. Upcoming show schedule always at www.fintechtalk.co

To join iValley click here, a 3rd generation startup factory, building, talking, and writing about the fintech, crypto-economy, and web 3.0 future we are creating with our ecosystems of startups, investors, and corporates.

Enjoy and always Be in the Know,

Paddy Ramanathan

Founder of iValley and Host of the FINTECHTALK™ Show

Table of Co̶n̶t̶e̶n̶t̶s̶ Future in this Edition

Banking/Fintech as a Service, Embedded Finance - What’s next - Save to Calendar -> June 9th at 12 pm PDT - With Synctera, Moov, DXC, and CFSB.

The FINTECH ELDER recap of FINTECHTALK Show on May 26th - The Future of Wealth Management in the Era of Digital Assets.

Bringing you the best in fintech and

crypto-economy right next to your barbecue

this summer!

Show schedule at www.fintechtalk.co, DM us on @iValleyIC if you’d like to come on the show!

Did you know Wealth Managers are looking for you? Yes, you!

Recap of May 26th FINTECHTALK Show on the Future of Wealth Management in the era of digital assets by the FINTECH ELDER

I reviewed my billions the other night, as I sat down with a scotch in my luxurious jacuzzi at my hide-out on an island in the West Indies.

It was so exasperating. Should I put two billion in that new rare metals fund or three in that old school real estate one? Decisions, decisions! And what about cryptocurrency? Should I put that spare 5 billion in it?

And then I woke up from that beautiful dream, shaken by a piercing ringing of bells.

It was my alarm, reminding me that I ought to attend a talk I had been looking forward to for quite a while. It was a Fintechtalk Clubhouse panel session on Wealth Management, hosted by the genial Paddy Ramanathan of iValley.co.

Paddy’s carefully curated panel sessions are always interesting. The panelists invariably know their subject and his probing questions unearth some great gems of wisdom.

For this well-attended session on May 26th, Paddy has invited three prominent individuals who know a thing or two about Wealth Management.

· Nancy Tengler, Chief Investment Officer at Laffer Tengler Investments

· Alessandro (Ale) Vigilante, Vice President Fintech & Emerging Businesses at Fidelity Investments

· Amy Oldenburg - COO at Morgan Stanley Investment Management

I leaned forward with interest. Since I’m so enormously wealthy, it was important for me to know what these professionals had to say.

Paddy got the ball rolling by noting that 6 Billion has poured in into fintech just this past year. He wondered if this meant that Wealth Management might be on the cusp of something big.

The view that emerged from the animated discussion thereon was that the same High Net Worth cohort was now demanding higher value services from Wealth Managers. There is a demand for new products - many of which didn’t exist before – and novel new assets. For example, there is pressure on wealth managers to understand and explain digital assets to demanding and knowledgeable customers.

New retail customers – who represent 34% of the trading market - do not seem to see the need for face-to-face interactions and are quite okay with working on their investments through tools. Yet, it is important for wealth managers to make customers understand the difference between speculation and investment.

Subtle but important point, I thought!

A new type of wealthy customer has emerged (you perhaps?) who is happy to use Roboadvisors. Those in this new category are looking at more engagement and want greater granularity in their investment decisions.

Since many are relatively young with several years of their careers left, they don’t think much about retirement; educating them about that is a new kind of responsibility that is placed on Wealth Managers.

Then again, there is the phenomenon of investment due to the fear of being left out. This is ultimately speculation, rather than well-thought-through investing.

That is a thought, and I’m seeing that phenomenon in cryptocurrency investing, where people’s actions seem to be driven by mob sentiment. Yes, I know you aren’t one of them!

This is very akin to erroneous investment decisions based on the number of eyeballs, seen in the 2000s, which we now understand was pure speculation.

The panelists believed that the Millennial generation was more interested in “experiencing”, rather than investing. But the Covid period has changed all that.

“At the end of the day”, said Nancy, “wealth management investment is serious business. Gamification trivializes it, like confetti falling when a stock is purchased.”

I agree with you, Nancy!

Nancy observed that Bitcoin is now treated as a commodity. Wealth Managers are not yet ready to own these assets but are willing to encourage their customers to consider them as a separate asset class, after telling them what it is all about.

Alessandro pointed that beyond CBDCs and bitcoins, the phenomenon of digital assets is showing great promise. Blockchain can be used to represent assets in the digital or physical worlds. Digital assets therefore can be part of a more sophisticated portfolio for which there is latent demand.

A new challenge for Wealth Managers is that the infrastructure needed to support blockchain is altering everything. It will affect payment settlements, for example. Automated Clearing Houses will result in the transfers being immediate and the old financial infrastructure will change drastically.

With Blockchain, since fraud is being prevented by the infra itself, some legacy participants may not be necessary. The acceptance of blockchain has moved to commercial banks, government etc. Embracing technologies has gone up and asset classes like bitcoins have been legitimized. (Did you know Walmart is now encouraging its suppliers to use blockchain?).

But have Wealth Managers kept up with all this? Possibly not, is what the panel felt.

Amy had an important observation: Millennials or Gen Z are technology natives all over the world, including developing economies. Wealth Managers need to think about how this new generation thinks of money. Could cryptocurrency perhaps co-exist with traditional investment vehicles for them? Maybe. But for now, understanding their priorities and the things they think have value, integrate unusual assets like sneakers and digital artwork in their portfolios if that is what’s important!

“How does ESG fit into portfolio planning?”, asked Paddy. (This guy always asks cool questions like this one!)

Amy asserted that values are very personal things. Her clients may be worried about oceans, social issues, carbon emissions, and so on. Wealth managers need to align investment opportunities with these values, and it is not always easy.

The general rule is to first maximize money and then be philanthropic. Of course, this raises fiduciary and ethical issues. At the end of the day, investment returns and ESG impacts have not yet happened in tandem.

As far as Wealth Management as a global discipline is concerned, US strategies won’t work in China or elsewhere. Wealth Management must be very country-specific.

One thing that is interesting about some of the competition in these countries is technology firms with super apps which potential clients could use versus going to a separate financial institution.

And what is the immediate future for wealth management? Let us list a few points that emerged.

1. Technology will help in financial democratization. Embedded finance will gain traction – for the first time financial institutions are participating in large numbers

2. While fintech companies are serious about Wealth Management, organizations like Walmart will also enter this field. Scaling will happen from unlikely companies.

3. Wealth Managers need to be sensitive to the newly wealthy and what they value.

I hope you feel energized now, with the right kinds of questions to ask your potential wealth manager.

As I jetted away from Clubhouse to my private island in the West Indies, I thanked my wealth manager for looking after me so well. I could have easily blown away my bucks but did not. And neither should you.

The Fintech Elder

- an enormously wealthy anonymous individual. He knows everything.

EPILOGUE

To join iValley as it builds the future of Wealth Management with its startups, corporates, and investor ecosystem - click here.

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd, E-909

San Ramon, CA 94582,

United States.

Phone: +1 925-575-7832