The Web 3.0 Spiders

How the decentralized web will disrupt the internet businesses

HI FINTECHTALKERS,

I sat down with the great Shamir Karkal (Co-founder and CEO at Sila, who was previously the co-founder of Simple), and the amazing Maia Bittner (ex-engineer turned fintech nerd | Forbes 30U30 | ) on the FINTECHTALK™ Show (http://www.fintechtalk.co) to talk about well the future, Web 3.0 and how it will all be different. A succinct summary of the conversation by the Fintech Elder and our editorial epilogue is in this edition of eFINTECHTALK following my foreword.

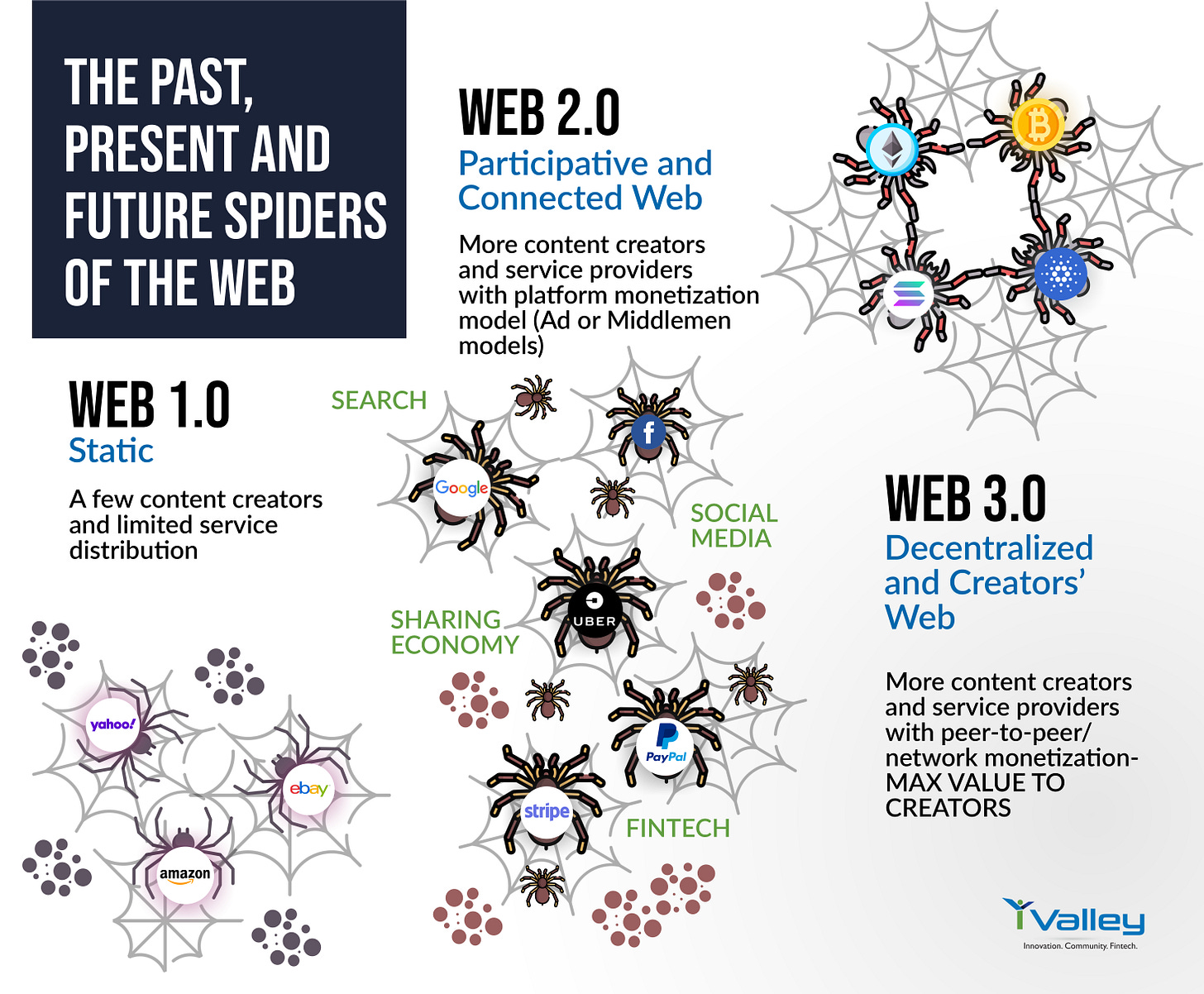

The promise of Web 3.0 simply is the disintermediation of internet businesses. Imagine on-chain search without Google, social media without Facebook or a decentralized ride-sharing service like Uber without Uber. Web 3.0 instruments like NFT will create equity for creators and producers beyond just digital art.

Web 3.0’s promise is to democratize the leverage of the internet’s distribution to creators and producers creating an on-chain (decentralized), peer-to-peer, multi-formfactor and multi-network internet of commerce.

So then is that Metaverse

The rebranding of Facebook as Meta has created a lot of buzz on Metaverse with quick announcements from just about everyone. Microsoft claimed that they are in the race to Metaverse with Avatars in Teams, Roblox CEO claiming their entire business created two decades ago foresaw this coming. While some of this is the usual riding the coattails of a new buzz, Metaverse or the Matrix is the 3rd layer of the Web 3.0 stack in its very early infancy. The convergence of digital, physical, virtual, and augmented reality for not only commerce but for experiences, jurisdiction/governance. See below.

There is a lot happening at Layer 1 and 2 in terms of new protocols and business models that will flush out in the next 12 to 24 months. From BTC and ETH to now Solana, Avalanche, Cardano, Polkadot, Polygon et al. From Coinbase, Binance and trading apps like Square, Robinhood to now Opensea, Rarible, and a multitude of seed-stage startups making NFT creation, launch, and monetization easy for all type of creators. iValley is working on some projects in this space and will be making some announcements/investments shortly.

While the Web 3.0/Crypto startups space is a bit frothy with inflated valuations, there are a lot of good ideas that will take shape in the next 12 to 24 months in DeFI, Internet platforms, and MarketingTech.

The Web 3.0 version of, Facebook, Amazon, Netflix, Uber etc - the new SPIDERS are in early stages of their formation.

iValley is a new kind of venture capital and startup factory, sculpting the future of fintech and crypto-economy and redefining venture capital with our inclusive innovation mission. To learn more about iValley click here.

Join me for our show next week's special edition of The FINTECHTALK™ Show, Wednesday, Nov 17th at 12 pm PDT, featuring the great Eugene Marinelli and others on Fintech hubs outside of SF and NY. Is the exodus from the coasts real? Are Austin, Memphis, South Florida, and other cities going to be fintech, crypto, and Web 3.0 hubs?

Join me live on Clubhouse.

Enjoy and always Be in the Know,

Paddy Ramanathan

Founder of iValley (www.ivalley.co) and

Host of the FINTECHTALK™ Show (www.fintechtalk.co)

Growing Fintech Hubs (Outside SF and NY)

17 November, Wed | 12: 00 PM PDT

Featuring:

Eugene Marinelli, Founder, and Investor

(Partner, Conversion Capital)

… and more!

Programing Money vs. Design Money Experience–Which is the Pen, and Which is the Sword, and Which is Mightier?

I was in a philosophical mood on the morning of October 13, brooding over the big question of whether technology at the back end is more significant than technology at the front end.

No, I am not one to say “It depends” or to take a middle ground. I like things in black and white. I like unambiguous answers to questions like: Are user experiences overhyped? Is back-end technology getting needlessly complicated?

So when I heard that there was a scheduled Clubhouse discussion that very afternoon titled Programming Money vs Design money – which is the pen and which is the sword and which is mightier? I re-arranged my calendar and logged in to listen.

I was not disappointed.

Paddy Ramanathan, the extremely well-networked CEO of iValley hosts these absorbing sessions about twice a month. This time he had two energetic voices:

Maia Bittner ex-engineer turned fintech nerd | Forbes 30U30 | startups and some other stuff. Officially, she is “Voice of the Member” at Chime – a Mobile Banking company.

and

Shamir Karkal Co-founder and CEO at Sila, who was previously the co-founder of Simple

And as you may have guessed, Paddy had cleverly positioned Maia as the voice of Design Money and Shamir as the voice of the Programming Money (all in jest, of course!)

Both had eclectic backgrounds. Maia has an e-commerce business and generally leans towards solving the financial problems of the average American consumer, who feels bewildered by mystifying credit card statements and other issues which are below the radar of most Fintechs. Shamir had worked his way through a career as a management consultant and techie. Both had a successful track record of growing and selling Fintechs (Finch and Simple respectively), so they certainly had a good idea of what works, though at opposite ends of the spectrum

Though the discussion was illuminating in understanding how two highly charged individuals spotted opportunities, created niches and worked hard to make things happen, it was also fascinating to listen to their views about banking fundamentals and how things are likely to evolve.

Maia showed sensitivity in promoting the material aspirations of consumers, which was very possible, she said, because “goods have become cheap”. The shift is now towards housing, healthcare, education and transportation, she said.

I have looked at one of her recent videos where she carefully disassembles credit card statements and suggests ways in which to simplify them. Obviously, this helps a consumer manage expenses better because they have a clearer idea of what’s going on.

Shamir had built the very first Neo bank – Simple - and had tremendous experience in back-end architectures. His new venture Sila, is an attempt to empower the fintech revolution by enabling technical connectivity.

Both were of the opinion that many new financial products were possible and old products like checking accounts may no longer be relevant. They felt that consumers can improve their financial health through technology; I certainly appreciated this sensitivity. How do customers wish to interact with their money; it was time, both felt, that one needed to work backwards after determining what people truly want.

What a simple but profound thought! Thus far, the customer has always felt helpless, bombarded with products she never asked for!

Of course, the elephant in the room is the huge amount of existing infrastructure to support old processes– how feasible would it be to abandon it? Clearly, we need to promote interoperability. Coins have been around for 2700 years and cheques for about 2000 – they continue to be used; the new DeFi/crypto world will have to coexist.

However, there is greater awareness that repeated processes can be streamlined – for instance, could Amex integration be made less painful? It currently takes 7-8 clicks to enroll in 10 minutes. A consumer is likely to find this painful and may abandon the process at any stage.

This brought a new and interesting twist to the conversation – is it actually a good idea to remove all friction in a process? A couple of startling examples were shared.

Every consumer thinks their situation is unique and wants the bank to discover it. So too short a survey would make them skeptical. Too long a survey would exhaust them. A right balance would need to be struck!

While Maia observed that if the User Interface supported friction in the right places, it might lead to better outcomes, Shamir brought forward a fascinating point: customers who interacted with customer service to help resolve their problems generally had a higher NPS!

Why?

Because they had evidence that their problems were being solved! And that is how trust develops.

Conversely, those who didn’t interact with the bank registered lower NPSs and lower trust!

In short, friction isn’t all bad!

That might see a shift as the newer tech savvy generation may not identify with this phenomenon and are quite happy not dealing with customer service at all!

Both predicted that we were barely at the tip of the iceberg as far as the Fintech revolution was concerned. Social media might be interesting but ultimately, for people, money is more important than photos and they give greater value to that! So instead of Facebook making money from users, for instance, users will start making money by using apps etc. on the internet by using apps; it will be a radical shift!

New types of concepts like Buy Now Pay Later are catching on. Credit Cards may be used in different ways! Even Insurtech may see a revolution!

I like Paddy’s conscious attempts to probe his panelists about diversity. This time again, he asked them what they thought. Both of them seemed committed and showed awareness of how diversity is necessary in the Fintech arena–both from the product development side and the usage side.

As the discussion wound down, I was left with a feeling of having just been in a very high-energy arena! Fintech is in safe hands!

And as to the question of whether the pen is mightier than the sword, the clear answer is that the pen cannot exist without the sword and the sword is meaningless without the pen!

I’ll see you at the next FINTECHTALK SHOW!

The Crypto Elder is a votary of technology with a human touch!

EPILOGUE

To join iValley as it sculpts (build, write, and talk) the future of fintech and crypto economy click here.

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd, E-909

San Ramon, CA 94582,

The United States.

Phone: +1 925-575-7832