Why Crypto and SaaS are Drowning in the 2026 Reset - Part 1

Decoding the hidden architecture of institutional wealth preservation how the institutional finance and Bitcoin maybe closer than you thought

The Shadow Swap Line: Why Bitcoin may have been the Central Bank’s Ultimate Insurance Policy

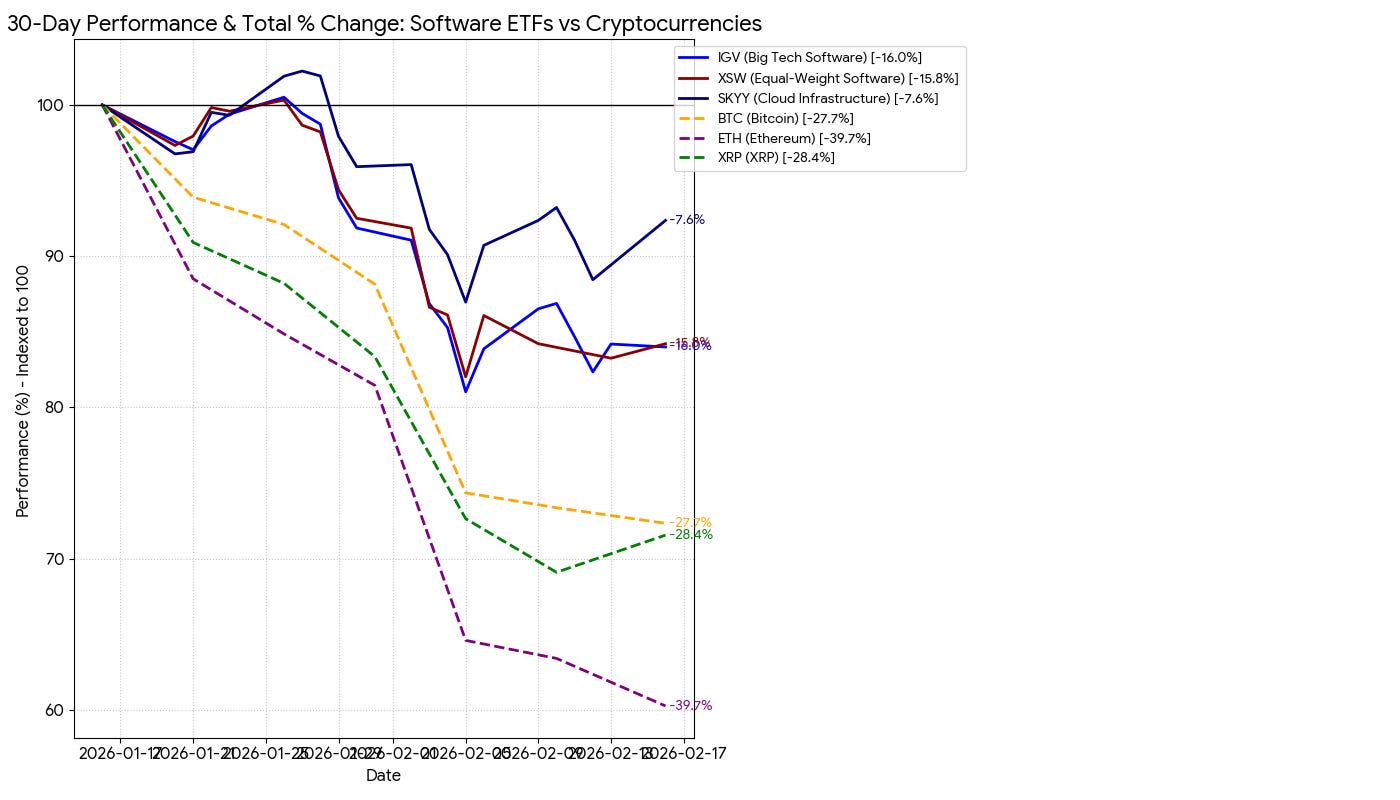

The data from the last 30 days isn’t just “red”—it is a systemic warning. We are witnessing an enormous market correction that has spared almost no one, and for the first time, the “Crypto Flywheel” is spinning in reverse.

At the time of writing of this article: From Big Tech (IGV) to the broader software market (XSW), SaaS stocks have taken a synchronized 16% hit this month. But the real carnage is in Crypto: major assets have plummeted 27% to 40% in just 30 days, leaving them a staggering 60% below their 2025 all-time highs.

Is this a temporary dip, or are the “Shadow Swap Lines” that fueled the last decade being permanently dismantled?

In this exclusive two-part deep dive, we move beyond the “cypherpunk” myths to explore a provocative hypothesis: That Bitcoin was a strategic synthesis unified by the financial establishment as a defense mechanism against the very QE they were forced to trigger. We connect the Four Forces re-architecting global financial services—from the “Warsh Shock” at the Fed to the Agentic AI disruption—and explain how the rules for institutional wealth preservation maybe changing.

In this article:

The Inside Job: Why the timing of the 2008 launch points to a sovereign “lifeboat” for Western elite capital.

Gold vs. Code: How Russia and China’s physical gold grab forced the West to engineer a weightless, digital alternative.

The 2026 Reset: Why the shift to “America First Finance” is intentionally draining the “speculative leak” of borderless rails.

Part 2 will be about Agentic AI & The Software Solvency Trap.

Disclaimers & Strategic Hypothesis Disclosure

Not Financial Advice: The content of this article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. All investments, particularly in digital assets, involve a significant risk of loss. Consult a qualified professional before making any financial decisions.

Hypothetical Framework: The theory that Bitcoin was an intentional “Shadow Swap Line” is a speculative macro-economic hypothesis. While supported by historical data and policy correlations, it is a non-consensus view and is not based on verified private disclosures from sovereign entities.

Forward-Looking Statements: Projections regarding “February 2026” and the “Warsh Fed” are based on current trendlines and hypothetical political scenarios. Actual market outcomes and policy shifts may differ materially.

Table of Contents

Keep reading with a 7-day free trial

Subscribe to FINTECHTALK™ Sculpting the future of fintech, AI, & Crypto to keep reading this post and get 7 days of free access to the full post archives.