Are Startup hubs coming to a city near you?

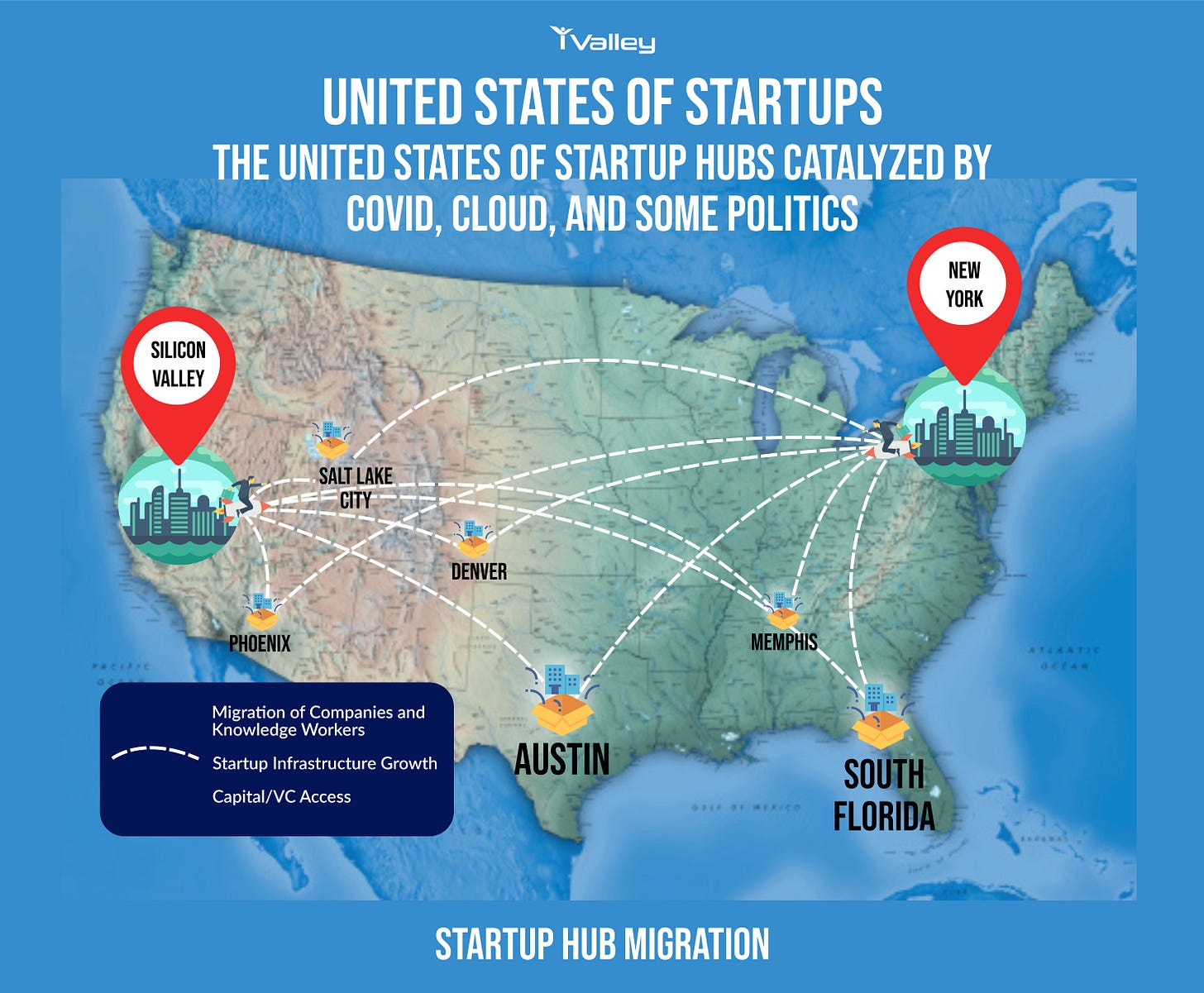

Covid, Cloud, and lack of political diversity are leading knowledge worker and venture capital migration out of hubs like Silicon Valley and NewYork to Austin and other business friendly destinations

HI FINTECHTALKERS,

I sat down with Eugene Marinelli (Conversion Capital and Blend Labs), and Allan Rayson (Encore Bank, Regions, BBVA) on the FINTECHTALK™ Show (http://www.fintechtalk.co) to talk about the recent trend of startup hubs around the country outside of the usual SF and NY theatre. A succinct summary of the conversation by the Fintech Elder and our editorial epilogue is in this edition of eFINTECHTALK and the recording is here.

Our research in the past has found a few major ingredients for a sustainable startup hub like Silicon Valley. An abundance of labor (knowledge workers), the proximity of established technology firms and market access, venture capital access (all stages seed to Series D), and a vibrant ecosystem that results in a hyperbolizing network effect of ideas and connections. There are other cultural aspects like the stigma of failure and the unrelenting tenacity to see unsuccessful endeavors as learning experiences and not failures.

The possibility of remote work in the Covid era, with Cloud-based development and tools like Discord, Zoom, Slack, and Teams, etc have caused a dispersion of knowledge workers with some concentration in places like Austin, and Southern Florida. Capital has followed and vibrant startup ecosystems are developing encouraged by business-friendly political leaders. Time will tell if this does to Silicon Valley and the Empire State what happened to Motor city in the early 2000s. I sure hope not.

We have included our most popular articles in 2021. Wishing all FINTECHTALKERs the best for 2022. Be bold and embrace the winds of change that Web 3.0 is about to bring.

Just like Web 1.0 and 2.0 transformed economies and societies even led to political revolutions, Web 3.0 will fundamentally transform how value flows between producers and consumers and how people and entities organize as networks across traditional corporate, and other jurisdictional boundaries.

Paddy Ramanathan

Founder of iValley (www.ivalley.co) and

Host of the FINTECHTALK™ Show (www.fintechtalk.co)

10 Macro Predictions

On Web 3.0

The Web 3.0 Spiders

The Crypto Matrix of the Future with Tokenized Real-World and Native Digital Assets

Fintechs Transfiguring Financial Products to Goal-Based Financial Solutions

Understanding Fintech Migration

Many years ago, I was transiting Dubai International Airport en route to an exotic destination.

While I had coffee by myself in a corner of a crowded café, I noticed several young men having a boisterous conversation a couple of tables away. They were clearly software engineers from India and their loud conversation made it obvious that they were on their way to San Francisco. I heard words and phrases like “opportunity”, “excited”, “perfect place for a startup” etc. I felt happy for them.

A young man stood by the table.

“May I sit here, please?” he asked politely. The way he spoke made it clear he was American.

“Of course!”, I said.

He made himself comfortable. And as all travelers at an airport do, we asked each other about our destinations.

“Chicago to Bangalore,” he said, smiling.

“Business or pleasure?,” I asked.

“Both, I’m going to work there. I’m moving. That’s where the action is.”

A counter-current moment.

Who moves permanently from Silicon Valley to Bangalore?

The reasons for migration through history are well known. Economic opportunity, wars and civil strife, disease, hunger – people move because they want to and sometimes because they are forced to.

Will this phenomenon hit the Fintech world someday, I mused?

So, when I read that the affable Paddy Ramanathan, CEO of the Fintech incubator, iValley, was hosting a session on Clubhouse on exactly that subject, I was intrigued. I logged into the session to listen in.

Paddy has a gift for identifying the right persons for his sessions and this time was no exception. The two panelists were Allan Rayson, Chief Innovation Officer at Encore Bank and Eugene Marinelli, Founder and Investor.

Eugene is a classic example of someone who swam against the current. Both coincidentally to operate out of Austin, TX.

The discussion proved to be very insightful. I believe that cities ought to understand why companies that constitute its social fabric think about moving or out.

Why do companies move?

Let’s take hard examples.

Oracle, HPE and Tesla have moved their headquarters and so have many others. It may not be about moving to Texas specifically, but the signals are there. As Web 3.0 becomes de facto, are there fewer incentives to physically operate out of the Bay Area, which we conventionally consider the crucible for innovation?

Eugene spoke of escalating costs and his disillusionment with the state of affairs in California. For him and other reverse-migrants, COVID has triggered the move and given them space to recalibrate and reorient. Austin, in this specific instance, gives a sense of familiarity while being different too.

But others do not move to places like Austin not just for business reasons (typically lower costs and lighter taxes) but for lifestyle. Behind the frenzy and burning desire to “make it” is a burning desire to enjoy the other pleasures of life. And that is the attraction, we hear, of places like Austin, where subtle qualities like being helpful and concerned about others seem to have become important after the COVID experience. The weather matters. Experiencing nature more fully matters.

Other things influence this kind of migration too: it’s become easier to attract and hire talent. There’s a sense of experiencing the pre-COVID normal; of not being required to wear a mask, sanitize and so on. Further, University of Texas has become a rich source of talent too!

You can see that a number of new variables are causing people to think about how they want to live their lives! Taxes, cost of living, weather, safety, softer issues like family – the list is growing.

Venture Capitalists

Over the years, even the VC community is showing a willingness to look at places like Austin. It’s now relatively easier to put a seed round together. Eugene spoke of a company that he has invested in actually moving to Austin to be closer to him! In the same spirit, there are instances of big exits happening which is helping to redeploy capital into newer ventures.

And there’s other hard evidence about VCs.

Jim Breyer of Breyer Capital and Palantir co-founder Joe Lonsdale of Palantir and 8VC plan to move from Silicon Valley to the city.

The latest VC to call Austin home is Geoff Lewis, founder & managing partner of Bedrock Capital, a four-year-old early-stage venture capital firm with $1 billion in assets under management. Lewis started his investing career at Founders Fund, where he was a partner for several years. He either serves or has served on the board of companies such as Lyft, Nubank, Vercel and Workrise.

New Fintech Crucibles

The Fintech innovation bug is alive in and well in places like Texas! Billd and Mozido are just two examples of companies that do not see the need to exist in Silicon Valley to get ahead.

The DeFi world is alive and well. Banking innovation, in cases like the buying and selling of mortgages on decentralized systems is creating new revenue opportunities. Banks like Encore believe that closer collaboration with Fintechs is necessary and mutually beneficial, especially as raising capital cheaply is part of a bank’s charter. Translation: there’s a pull in the market.

The Energy Argument

But what do you think is a little-known mega-incentive for certain kinds of companies to move to Texas? Energy savings! Yup! As Allan pointed out, there’s no state income tax and there’s complete energy independence. That’s a perfect lure for those wanting to do some bitcoin mining!

All told, with the rapid spread of Web 3.0 and some strong financial and lifestyle arguments, I believe there will be serious exodus from Silicon Valley to new destinations. Innovation centers cannot afford to be lackadaisical and will need to reinvent themselves constantly.

The Crypto Elder is in a constant quest to challenge conventional wisdom.

EPILOGUE

To join iValley as it sculpts (build, write, and talk) the future of fintech and crypto economy click here.

Connect with us!

iValley Innovation Center

11040 Bollinger Canyon Rd, E-909

San Ramon, CA 94582,

The United States.

Phone: +1 925-575-7832