Hi FINTECHTALKERS, (These opinions are mine and not of the guests of my show)

It is commonly accepted wisdom in Silicon Valley that venture capital (VC) portfolio, especially early stage, follow the power law and not the normal distribution - a small number of investments make huge returns whereas a large number don’t even return the invested capital. Given this reality, venture capitalists focus on startups with odds of achieving higher-than-average success, a fact they openly acknowledge. It is frequency vs. magnitude of success or the assessment of that at an early stage. This assessment is very subjective as they prioritize specific trends or ideas simply because they're popular within their social circles or if the founding team has connections within their extended network. Simply put, it is group think with a lot of bias which are not signals of business success or any value analysis. To make matters worse they think this is a strength. Vinod Khosla, a prominent Silicon Valley venture capitalists (VCs) and the founder of Khosla Ventures, candidly admitted to Harvard Business Review that the power dynamic swiftly shifts when VCs become enthusiastic about a startup, particularly if it receives offers from other firms. "The best startups with inspiring entrepreneurs face intense competition for funding," he remarked. However, what is seldom said is that minority founders, such as Black or Latino founders, often do not fit the profile of “best startups” or “inspiring entrepreneurs” due to biases inherent within these elitist capital allocators. 1 2 3.

A living example of this bias is Tope Awotona, the now billionaire founder of Calendly. Awotona, a black entrepreneur from Atlanta (originally from Nigeria), bootstrapped Calendly by draining his bank and 401(k) accounts, according to publicly available news articles and Calendly website (see screen shot below). It wasn't until eight years into his journey that he raised venture capital, Calendly now is valued at over $3 billion (he may have got some seed capital from a local Atlanta Ventures). Awotona likely did not meet the “inspiring entrepreneurs” label for Khosla and his Silicon Valley peers. Mr. Awotona persisted but several others don’t and cannot.

Source - Calendly Website

“I raided my bank account and 401(k) to launch Calendly in 2013. Eventually, I ran out of money and started to seek VC funding. I had a working product, and customers using it, and everyone said no. Meanwhile, I watched other people who fit a different “profile” get money thrown at them for shitty ideas. Those VCs were ignorant and shortsighted. The only thing I could attribute it to was that I was black,” he told media. Tope Awotona as quoted in https://peopleofcolorintech.com/ Emphasis added

Moreover, when a startup garners the backing of VCs, these investors often pull out all the stops to ensure its success. They employ various mechanisms, such as venture debt and mutual co-investments at inflated valuations, practices that go unscrutinized in private markets but arguably should be, especially considering that much of the capital originates from pension funds and 401(k)s. In the wake of the SVB collapse, VCs have lost access to tools like venture debt that were once used to amplify leverage and prop up valuations. This shift demands a more value-based approach to portfolio construction. Previously, VC-friendly banks like SVB facilitated venture debt through concentrated deposits, a strategy encouraged by Silicon Valley VCs who insisted their portfolio companies bank there. I explored this issue last year, highlighting concentration risk and the perils of venture debt as key factors in SVB's downfall. Private investments, especially in early-stage ventures, don't get scrutinized much, allowing for big gambles (unreal valuations) and the ability to influence co-investors. However, if factors such as race are influencing investment decisions, aren't we on a slippery slope? Shouldn't there be more reporting to at least increase transparency? 4

To further illustrate my point, let's delve into the data on VC selections, which underscore how early-stage investment practices of venture capitalists are little more than a glorified lottery ticket selection process, heavily biased against minority founders, particularly Black and Latino entrepreneurs.

The statistics reveal a stark concentration of returns in venture capital investments: a mere 6% of investments, representing only 4.5% of the total invested capital, account for approximately 60% of the total returns. Conversely, about 50% of the companies (around 37% in dollar terms, see graph below) in which VCs invest fail to provide returns greater than 1x. This highlights a significant inefficiency in the allocation of capital and underscores the need for a more equitable and performance-based approach in VC practices.

Source - Correlation Ventures blog post

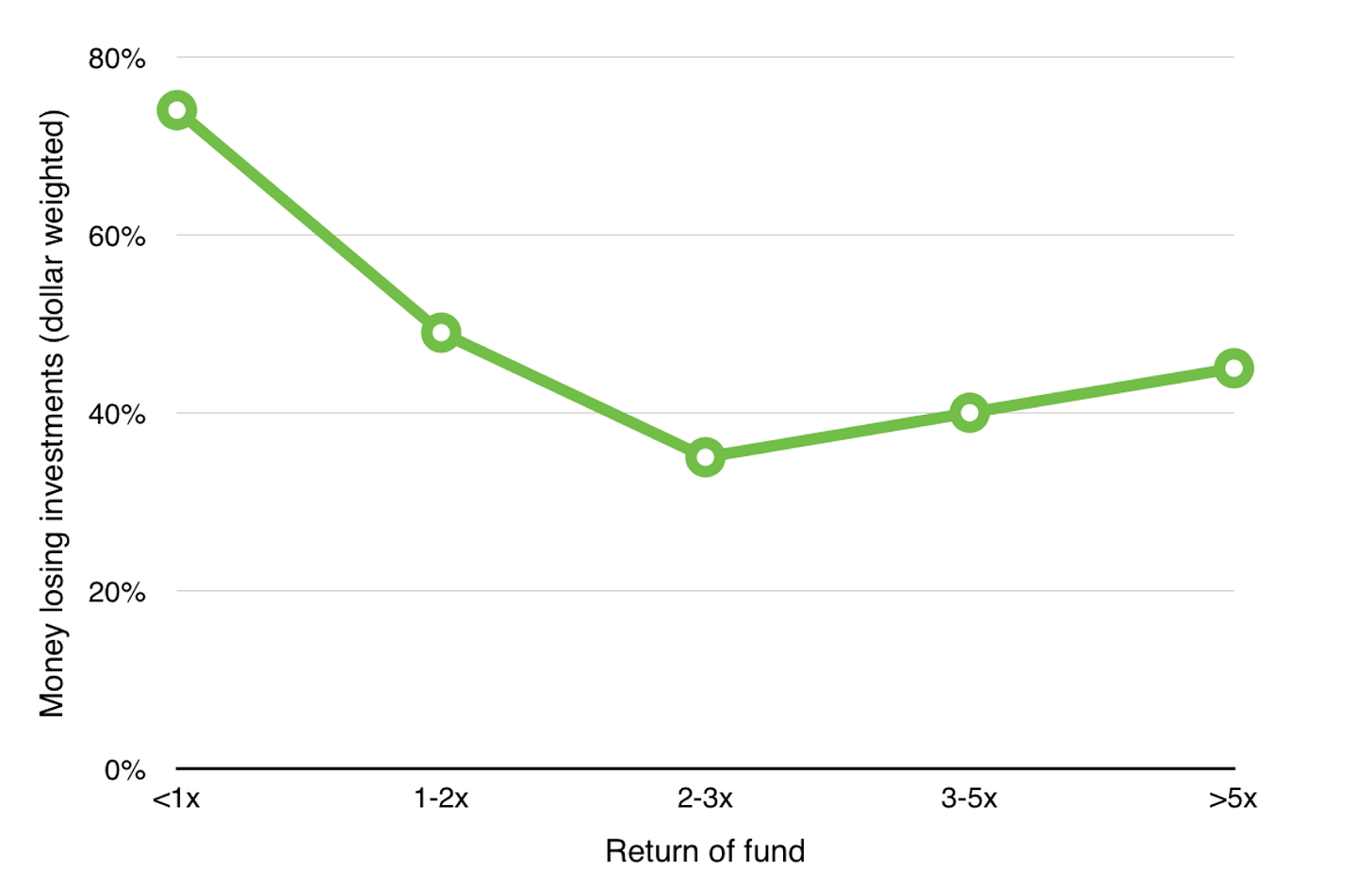

Many funds underperform, and even the successful ones are burdened with numerous money-losing investments. For example, underperforming funds have nearly 80% of their investments underperforming, both in terms of dollar value and the number of investments. Conversely, even a fund that achieves a 5x return still has over 40% of its investments losing money, which is higher than that of 2-3x performing funds. See graph below. This suggests that the primary difference between highly successful funds and less successful ones isn't superior overall performance across their portfolios but rather the success of one or two high-risk, high-reward investments that paid off significantly - they don’t always but since it is huge factor VCs almost look for that and leave money on the table in the process. This further emphasizes the need for a more judicious and equitable approach in venture capital investment strategies.

Source - Correlation Ventures blog post

Now, let's examine the stark disparity in venture capital allocations to minority founders and the vast opportunities they are uniquely positioned to capitalize on. In 2023, Crunchbase reported that Black-founded startups received a mere 0.5% of the $140.4 billion in VC funding—only $0.7 billion in total. Considering that Black individuals comprise about 13% of the U.S. population, this allocation is woefully inadequate. McKinsey estimates the Black consumer market at approximately $300 billion, presenting a significant opportunity for Black startup founders.

Latinos, who start more businesses per capita than any other racial group in the U.S., fare slightly better but still receive less than 2% of venture capital funding. The total economic output of Latinos in the U.S. is around $3.2 trillion, nearly 15% of the nation's GDP. Latino founders are well-positioned to tap into this substantial market, particularly in sectors like healthtech, edtech, fintech, and eCommerce.

Investing in minority founders represents a tremendous opportunity for investors, especially those building in areas where they hold natural advantages. One of the fundamental principles of successful startup investing is that founders with a personal connection to what they are building have a higher chance of success. By recognizing and addressing these disparities, venture capitalists can unlock significant untapped potential and drive more economic growth.

To summarize, the overall track record of venture capital selection is not impressive. Venture capitalists often fall prey to groupthink, prioritizing specific trends or ideas because they are popular within their social circles or because the founding team has connections within their extended network. This approach has led to significant underperformance in many funds. Meanwhile, minority founders, who have been neglected by the VC community for decades, are uniquely positioned to deliver substantial returns. They have a deep understanding of and connection to the markets they serve, making them well-suited to solve specific problems and capitalize on significant opportunities.

I sat down to discuss all this and what can be done with Linda Haddad, Director and Program Coordinator at Bank of America’s Breakthrough Lab (BTL) - an accelerator for underrepresented founders, Laura Moreno Lucas, General Partner L’Attitude Ventures - a VC firm focused on Latino founders, Stephanie Joseph, CEO of Kura - BTL Cohort 3 member, and Maria Medrano, CEO of Inspirame - also BTL Cohort 3 member. We cover a lot of ground with this all women panel on the reasons and what can be done to raise awareness to this missed opportunity for investors and the community at large. While certain corporations and specialized venture capital firms have started to acknowledge and seize upon these opportunities, there's still ample scope for enhancement, particularly from limited partners and institutional investors, and potentially regulatory oversight, and policy maker scrutiny.

The data unequivocally indicates that venture capitalists are leaving potential returns on the table, failing to meet performance expectations, and disproportionately underfunding minority founders. The temporary surge in funding for minority founders in 2021 has faded, with 2023 investments falling below 2020 levels. This shows that VCs will not change unless held accountable. Limited partners, institutional investors, corporate partners, and the startup community must demand transparency and accountability within the VC industry.

With changing economic conditions, global innovation hubs, and the loss of tools like venture debt, Silicon Valley VCs will find it increasingly challenging to achieve extraordinary 10x returns on individual investments. This situation underscores the necessity for a more resilient approach, focusing on diverse and robust portfolio companies that consistently perform well. Limited partners and institutional investors must recognize this need and act promptly to avoid the risk of diminishing returns from an already struggling asset class. Holding VCs accountable for value driven funding practices is not only a moral imperative but also a necessity for sustained financial performance.

Click here to learn more about BTL and to apply to Cohort 4

Click here to learn more about L’Attitude Ventures

Click here to learn more Kura Technologies

Click here to learn more about Inspirame

Enjoy and always be in the know,

Paddy Ramanathan

Follow me on the new Twitter (X) @PaddyRamanathan

Founder of iValley (www.ivalley.co) and

Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)

Thanks to chatgpt, Evita Grant and Eza D’Souza for suggestions.

(Violin piece in podcast, courtesy of my daughter Ilina)