Welcome FINTECHTALKERS!

In this episode, I sat down with Brandon Card, Founder & CEO of Terzo, to explore one of the most overlooked foundations of enterprise value: contracts.

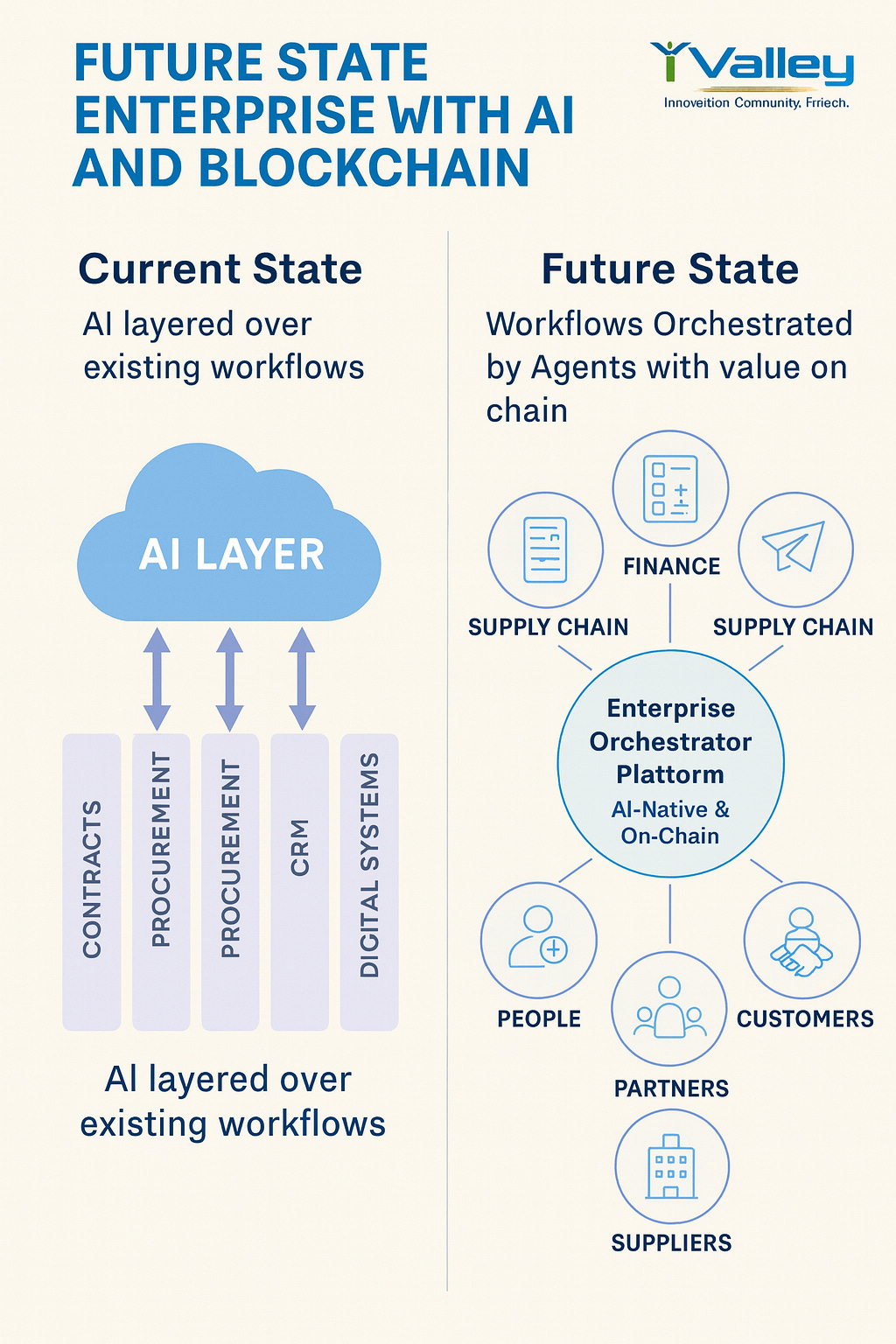

FINTECHTALK’s view: the future enterprise won’t be run by today’s ERP, CRM, or core banking stacks—it’ll be run by an AI orchestrator that coordinates value flows across agent-based suppliers, partners, customers, and internal functions like finance, with much of that value moving on-chain.

The schematic below shows the future state. Left: an interim phase where existing workflows remain intact but gain an AI “overlay.” Right: the end state, where workflows are rebuilt into an on-chain exchange of value, dynamically executed and optimized by AI agents. Companies like Terzo are already building early versions of this future-state orchestrator engine.

Figure 1 - FINTECHTALK’s view on future state Enterprise architectuer with AI agents and Blockchain based systems of value.

While Wall Street debates tokenizing equities and increasingly exotic instruments, the real unlock for Main Street and enterprise businesses is happening elsewhere. It’s in what companies like Terzo are doing—turning buried enterprise assets like contracts into liquid, actionable value. This is where tokenization gets practical: Wall Street–grade capabilities such as pricing intelligence, risk visibility, and cash-flow foresight, brought to everyday businesses by structuring and activating their own data.

Brandon’s journey—from Oracle and IBM to Microsoft—gave him a front-row seat to the same problem repeating at scale. Enterprises sign thousands of contracts worth trillions of dollars, yet the financial intelligence inside those agreements remains trapped in static PDFs, disconnected from finance, procurement, and ERP systems that actually run the business.

With Terzo and its latest platform, NirvanAI, contracts become more than legal artifacts—they become financial assets. We discuss how core platforms like ERP, procurement, CRM, and banking systems will evolve into AI- and blockchain-native systems of value, not just systems of record. In doing so, enterprises gain access to tooling and insight that was once reserved for big banks and firms like Palantir—but now purpose-built for the Fortune 500 and beyond.

If you care about enterprise AI, agentic systems, or how trillion-dollar businesses are quietly being re-architected from the inside out, this conversation is essential listening.

🎧 Listen Now to hear how Terzo is building what Brandon calls “the Palantir for finance.”

Timestamp Table

0:00 – 2:00 – Welcome + Meet Brandon Card

From Oracle to Microsoft to founding Terzo.

2:01 – 5:30 – The Contract Blind Spot

Why finance teams don’t actually control their most valuable data.

5:31 – 9:00 – $120 Trillion Locked in PDFs

How contracts quietly underpin revenue, spend, and partnerships.

9:01 – 12:30 – Contracts as Financial Assets

Why treating contracts as “legal documents” is a massive mistake.

12:31 – 16:30 – Why ERP Systems Miss the Mark

SAP and Oracle own transactions—but not the agreements behind them.

16:31 – 20:30 – Introducing NirvanAI

Terzo’s financial command center for contracts, spend, and revenue.

20:31 – 24:30 – Accuracy Over Hype

Why finance demands 99% accuracy—and most AI tools fall short.

24:31 – 28:30 – Purpose-Built vs Platforms

Why Terzo positions itself as the Palantir for finance.

28:31 – 33:30 – Fortune 500 Go-To-Market

Why Terzo focuses on the most complex enterprises first.

33:31 – 38:30 – AI in Production, Not R&D

What it takes to deploy AI systems enterprises actually trust.

38:31 – 44:00 – The Future: Contracts on the Ledger

Smart contracts, blockchain, and contract-to-payment automation.

44:01 – 49:00 – The AI ERP Opportunity

Why the next Oracle won’t look like an ERP at all.

49:01 – End – Raising Series B + Final Thoughts

Building a category-defining enterprise intelligence platform.

FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.

Ranked by ListenNotes

If you’re building the next-generation enterprise stack—disurpting ERPs, CRMs and Core banking—where AI + blockchain rewire how finance, procurement, supply chain, and operations actually run, FINTECHTALK helps you turn that vision into a category narrative, not just another pitch deck. We work with founders and innovators to translate your product thesis into a clear “why now,” a differentiated point of view, and a story the market can rally around.

Through our Narrative Blueprint collaborations, over 4–6 weeks we help you:

Run founder interviews and a positioning workshop

Craft a 60–90 minute flagship episode

Publish a 3–5k word Substack deep-dive

Produce a crisp executive 2-pager and a “where you fit in the next-gen AI + blockchain enterprise stack” infographic.

Ship a social pack of posts and clips your team can use across channels

We also partner with PR/creative agencies via an affiliate model, and with VC & corporate innovation teams through a VC + Corporate Innovation Blueprint that links your fund thesis to an Insight Lab for your portfolio and strategic partners.

If you see your company in what follows—or want to be on the 2026 watchlist—Schedule a scoping call today or email us at fintechtalk at substack dot com

Enjoy and always be in the know,

Paddy Ramanathan

Founder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)

Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.

Thanks to ChatGPT for suggestions.

(Violin piece in podcast, courtesy of my daughter Ilina)