Welcome FINTECHTALKERS!

Money is having a history moment again. Stablecoins, tariffs, reshoring, central bank independence, “Global South” monetary narratives—these aren’t disconnected headlines. They’re signals that the rules, rails, and power centers of money are being contested in real time.

Money’s Long Arc, Stablecoins’ Next Level: Adam Braus on History, Hayek, and Innovation

In this episode, I sat down with Adam Braus (Chair of Applied Computer Science at Dominican University of California)—a rare mix of engineer and economic-history mind, and a thoughtful skeptic (definitely not a crypto-maxi). Adam is a wealth of knowledge on how monetary systems actually form: what holds them together, what breaks them, and what replaces them. We covered stablecoins and onchain finance, but the real value was the way Adam kept pulling the discussion up a level—what money is for, who it serves, and how institutions evolve when trust fractures or geopolitics shifts. Adam didn’t just talk stablecoins—he walked us through 250 years of U.S. monetary history, explaining how each era of money was shaped by a mix of crisis, politics, technology, and institutional redesign: from coins and fragmented bank notes, to the Fed and the New Deal state, to Bretton Woods and the fiat turn, to the post-2008 legitimacy shock, and finally to blockchain and tokenized dollars. Along the way, he brought a distinctly Hayekian currency lens—focused on what happens when money becomes more competitive, more privately issued, and less monopolized by the state. Companies building the new financial fabric in banking and capital markets will benefit from Adam’s knowledge and perspective.

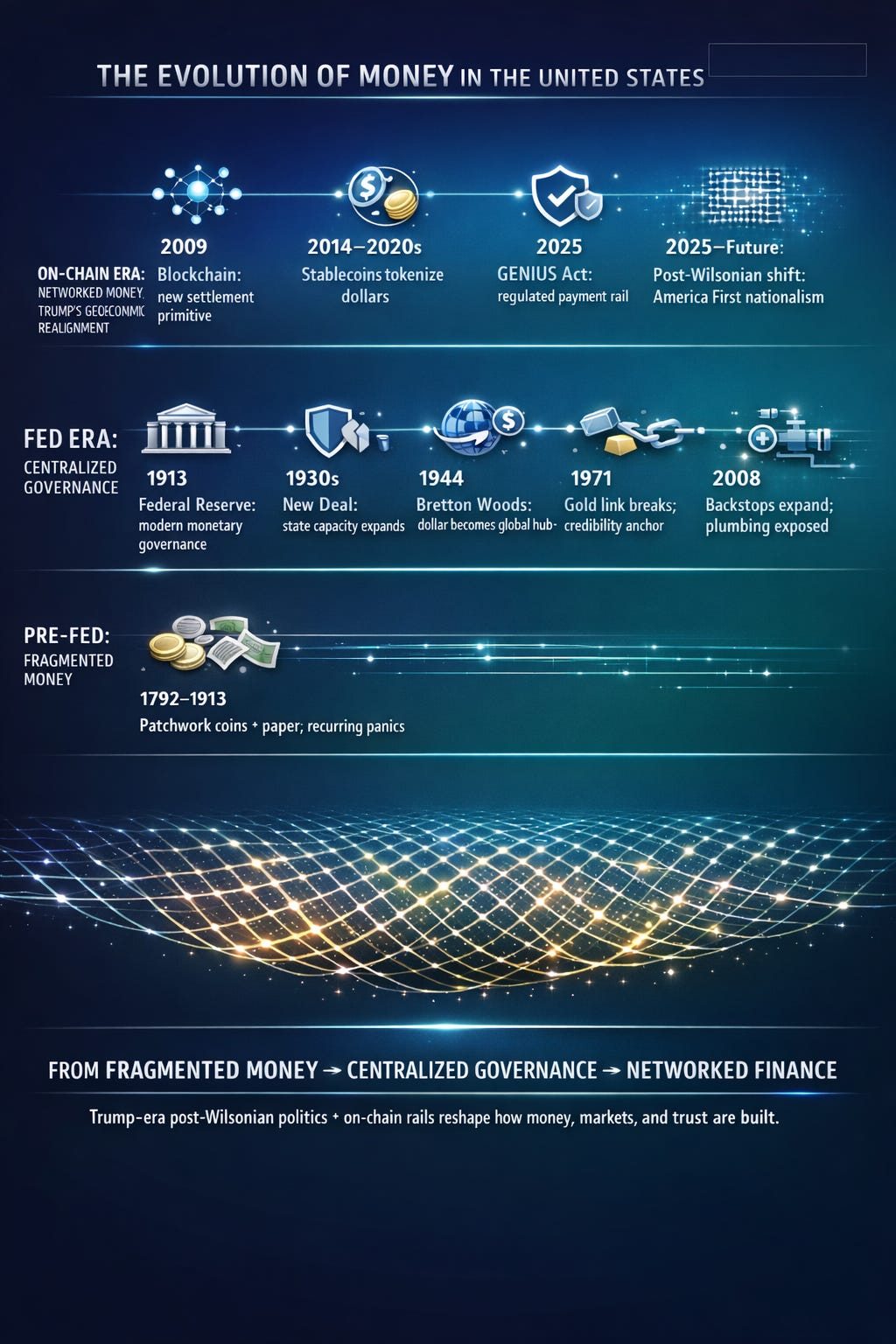

A very brief 250 year Dollar history

Listening back, the conversation maps onto a 250-year arc—money as a sequence of institutional upgrades and rails upgrades:

1792–1913: a patchwork of coins and fragmented paper, with recurring panics.

1913: Wilson’s architecture—Federal Reserve (and the broader fiscal state) begins modern centralized monetary governance.

1930s: FDR’s New Deal expands state capacity to manage crises and shape the economic order.

1944: Bretton Woods locks in the dollar as the hub of global trade and reserves—fueling a century of U.S.-led international order.

1971: the gold link breaks; credibility and macro management become the anchor.

1976: Hayek publishes The Denationalisation of Money—arguing that government monopoly over money should be challenged by competitive private currencies as a discipline mechanism against inflation and political cycles.

2008: crisis backstops expand; the plumbing becomes visible; legitimacy debates intensify. 2008 forced the state to act as a bigger financial backstop, exposed the hidden mechanics of credit and liquidity, and sparked lasting fights over fairness, power, and trust in the system.

2009: Satoshi introduces blockchain as a new settlement primitive—rules enforced by networks, not intermediaries.

2014–2020s: stablecoins tokenize the dollar—same unit of account, new distribution and settlement rail—while tokenization begins spreading to Treasuries and beyond.

2025: GENIUS Act—stablecoins get federal rules (reserves + oversight), legitimizing them as a regulated dollar payment rail.

2025–Future: Trump-era “post-Wilsonian” money—tokenized assets and on-chain finance become the new fabric of markets, shifting monetary power outward as the central bank’s role is narrowed, contested, or re-architected.

Editor’s Note (Post-Record Addendum):

Wilson/FDR to Trump: Central Control → On-Chain Rails + Tokenized Assets

Challenging the Wilson–FDR Monetary State

Trump’s confrontation with the Federal Reserve is not just personality or politics—it’s a challenge to the Wilson-and-FDR architecture that defined the last century. Wilson—and FDR after him—expanded the federal government’s role as the referee of capitalism: permanent fiscal and monetary institutions built to fund a larger state, manage crises, and sustain an internationalist order. In that framework, interest rates—set by an increasingly powerful Fed—function like a kind of indirect taxation, shaping capital allocation across the economy and reinforcing a system optimized for macro-stability and global leadership.

Is the Fed really independent?

But I’d add one sharper layer: the Federal Reserve is not really “independent” in the way civics textbooks present it. It is structurally and culturally intertwined with the globalization project—and with the financial sector whose business model is advantaged by it: deep global capital markets, reserve-currency plumbing, and cross-border flows. Trump’s “America First” nationalism sits in direct contrast: he’s implicitly arguing for a regime where the reward function tilts upward for American producers—manufacturers, farmers, and entrepreneurs—relative to financiers. Here’s where I land after the discussion (not Adam’s opinion—just mine).

America First vs Globalization Finance

Trump’s worldview starts from a different diagnosis: globalization is not a neutral efficiency machine—it’s a strategic threat. In his framing, decades of offshoring, trade deficits, and supply-chain dependence weakened the industrial base, hollowed out communities (especially across the Midwest), and ceded leverage to rivals. So his doctrine emphasizes nationalism as statecraft: reshoring, tariffs as leverage, deregulation, lower taxes, and attracting capital into U.S. assets and factories rather than overseas capacity.

Reframing the Fed’s Mandate Through Industrial Policy

That’s why Trump doesn’t treat the Fed’s dual mandate as “trade-policy neutral.” In his view, trade policy and industrial policy are upstream drivers of employment outcomes. If import competition and offshoring permanently reduce the number and quality of jobs in entire regions, then “maximum employment” becomes inseparable from the structure of trade and production. From that perspective, a central bank that focuses narrowly on inflation and aggregate employment while ignoring deindustrialization is missing the variable that determines whether employment is broadly distributed and politically sustainable.

Rates as Strategy: Macro Stabilization vs Sovereign Reindustrialization

His battle with the Fed over rates follows logically. High rates are more than a technical tool—they are a barrier that diverts capital away from domestic rebuilding. They raise the hurdle rate for factories, new capacity, and risk-taking, and make it harder for reindustrialization to win against global arbitrage. So the conflict isn’t simply “Trump wants lower rates.” It’s a clash between technocratic macro-stabilization inside the Wilson/FDR framework versus sovereignty-first industrial revival that treats money, trade, and production as one integrated strategy.

Perfect Storm: Trump-Era Nationalism + On-Chain Market Infrastructure

And now layer on the other shift: onchain finance is no longer just stablecoins. The same tokenization logic is extending across Treasuries, equities, credit, derivatives, and real-world assets—transforming settlement and clearing, but also issuance, custody, compliance, and liquidity formation. If Wilson/FDR built the last century’s financial operating system, we may be entering a post-Wilsonian, post-New Deal — Trump era—with a new international order emerging as markets are rebuilt on programmable rails.

The fight isn’t over rates—it’s over who America is built to serve.

🎧Listen now for Adam’s Hayek-and-history lesson on money—how currency systems are built, why they fail, and what today’s experiments might be signaling.

Timestamp Table

0:00 – 2:30 — Opening thesis: Stablecoins as competitive currencies

Stablecoins framed not as payments UX, but as the first mass-market step toward Hayek-style competitive money.

2:31 – 6:00 — Trump, the Fed, and monetary tension

Why the Trump–Federal Reserve conflict signals a deeper architectural shift, not just political noise.

6:01 – 9:30 — From Woodrow Wilson to Bretton Woods

How 20th-century monetary architecture shaped today’s centralized financial system.

9:31 – 14:00 — Money as a technology

Why money evolves like software—and why stablecoins are a protocol change, not a product.

14:01 – 18:30 — Why stablecoins arrived now

Smartphones, APIs, crypto rails, and global demand converging at the same moment.

18:31 – 23:00 — Private money vs state money

Historical parallels: free banking eras, private issuance, and why governments eventually respond.

23:01 – 27:30 — Trust, legitimacy, and adoption

Why people adopt currencies: reliability first, ideology second.

27:31 – 32:00 — Banks’ existential dilemma

Why banks can’t fully embrace stablecoins—but can’t ignore them either.

32:01 – 36:30 — Stablecoins vs CBDCs

Why CBDCs solve control problems, not innovation problems.

36:31 – 41:00 — Regulation as inevitability

How regulation will shape stablecoins without killing them—and who benefits.

41:01 – 45:30 — The global south use case

Why stablecoins matter more in unstable monetary regimes than in the U.S. or Europe.

45:31 – 50:00 — Programmable money & economic coordination

What happens when money becomes composable infrastructure.

50:01 – 54:30 — Inflation, debasement, and exit valves

Why stablecoins act as pressure-release mechanisms in inflationary systems.

54:31 – 58:30 — The long arc of monetary evolution

Why this shift is generational, not cyclical.

58:31 – 1:03:00 — What breaks first

Legacy banking rails, settlement delays, and policy lag.

1:03:01 – End — Closing synthesis

Stablecoins as the bridge between nation-state money and network-native value systems.

FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.

Ranked by ListenNotes

Looking to amplify your brand’s reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.com

Enjoy and always be in the know,

Paddy Ramanathan

Founder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)

Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.

Thanks to ChatGPT for suggestions.

(Violin piece in podcast, courtesy of my daughter Ilina)