Welcome FINTECHTALKERS!

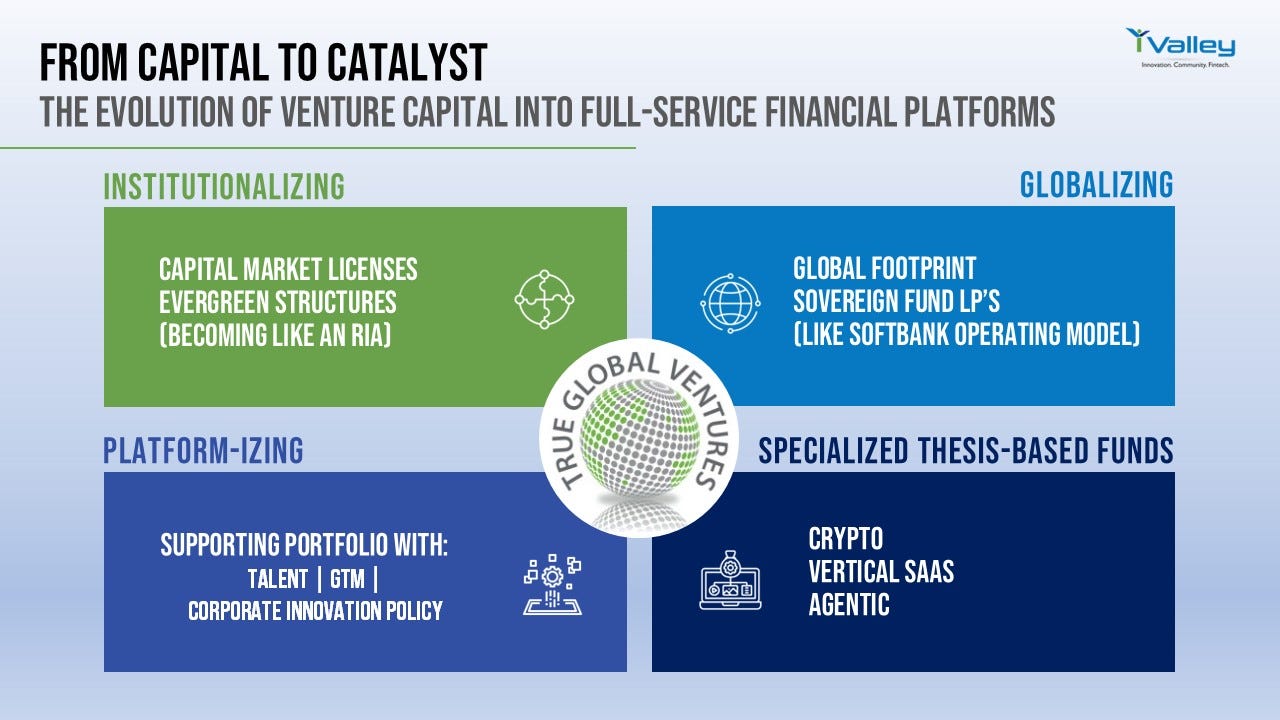

In this episode, I sat down with Beatrice Lion, CEO and General Partner at True Global Ventures (TGV), to explore how they are part of bigger trend in venture capital of is evolving into a full services financial services platform - multi-stage, multi-instrument, global, services platform with thesis based funds. TGV now operates with RIA-like flexibility, much like leading Silicon Valley firms (Sequoia, a16z, Lightspeed, General Catalyst, Bessemer, Founders Fund). This evolution in Venture capital gives the firms flexibility to hold non-traditional assets and manage capital in more evergreen/long-horizon ways—balanced by heavier compliance.

Beyond adopting RIA-style structures, venture firms are increasingly differentiating themselves through full-service platforms for portfolio companies—covering talent, go-to-market (GTM), and policy/lobbying support—alongside global footprints and specialized, thesis-driven funds as depicted in the infograph below.

From Singapore to San Francisco, Beatrice has helped shape TGV into one of the most globally connected VC firms, with investments in Animoca Brands, Sandbox, Forge Global, Ledger, and more. With TGV’s new Capital Market Services license in Singapore—the equivalent of a U.S. RIA license—the firm can now invest across asset classes including secondaries, continuation funds, crossover funds, and even crypto.

We dive into Beatrice’s journey—from her early start in venture investing to leading TGV since 2017—and unpack what makes their model different: 25–35% GP commitments, high-touch engagement in the first 12–18 months post-investment, and a platform that connects founders to deep networks across eight global cities.

💡 Key Takeaways from the Episode

A different VC model: Partners commit up to 35% of fund capital—far above the industry norm.

License to scale: New MAS license enables TGV to invest in secondaries, public markets, and crypto—beyond traditional VC.

Eight-city footprint: San Francisco, New York, London, Paris, Stockholm, Singapore, Hong Kong, Dubai.

Portfolio powerhouses: Investments in Animoca Brands, Sandbox, Forge Global, Ledger.

High-touch playbook: Most value delivered in the 12–18 months after investing—then handing off to growth-stage funds.

Platform advantage: 71+ curated events, 16,000+ contacts, BD intros, and debt financing support for portfolio companies.

Trends to watch: Stablecoins, digital asset treasuries, and real-world asset tokenization in blockchain; consolidation and productivity ROI in AI.

🎧 Listen Now to hear how Beatrice Lion and TGV are reshaping the VC landscape with a full-stack, global, high-touch model.

Timestamp Table

0:00 – 2:00 – Welcome + Meet Beatrice Lion

From early career in venture to leading TGV since 2017.

2:01 – 6:30 – What Makes TGV Different

Why partners commit up to 35% of fund capital and how that changes incentives.

6:31 – 11:00 – The License to Scale

TGV’s new Capital Market Services license in Singapore and what it unlocks—secondaries, public equities, and digital assets.

11:01 – 15:30 – A Global Footprint

Eight cities, one platform—how TGV connects founders to networks in San Francisco, New York, London, Paris, Stockholm, Singapore, Hong Kong, and Dubai.

15:31 – 20:00 – Portfolio Highlights

Animoca Brands, Sandbox, Ledger, Forge Global, and how TGV backs global category leaders.

20:01 – 25:00 – The High-Touch Playbook

Why the first 12–18 months matter most, and how TGV supports founders with business development, fundraising, and debt financing.

25:01 – 30:00 – Events, Networks, and Community

71+ curated events, 16,000+ contacts, and how portfolio companies tap into the ecosystem.

30:01 – 35:00 – AI and Blockchain Trends

Consolidation in AI, productivity ROI, stablecoins, real-world asset tokenization, and digital asset treasuries.

35:01 – 38:00 – Secondaries and Continuation Funds

How TGV is leaning into crossover opportunities and the next frontier in venture.

38:01 – 40:00 – What’s Next for TGV

Beatrice’s vision for the next stage of global, multi-instrument venture investing.

40:01 – 42:00 – Closing Thoughts + How to Connect

Where to find Beatrice Lion and learn more about TGV.

FINTECHTALK: A Top 10% Global Podcast Shaping the Future of Fintech, AI, and Crypto and was recently ranked in the Best 100 Future Tech Podcasts by Million Podcasts.

Ranked by ListenNotes

Looking to amplify your brand's reach? Partner with our podcast and connect with an engaged and loyal audience. Contact us today to explore sponsorship opportunities and elevate your brand! fintechtalk@substack.com

Enjoy and always be in the know,

Paddy Ramanathan

Founder of iValley and Host of the FINTECHTALK™ Show (on Substack, Apple Podcast, YouTube, and Spotify)

Interested in sponsorship opportunities and be associated with sculpting the future? Please reach out to fintechtalk@substack.com.

Thanks to ChatGPT for suggestions.

(Violin piece in podcast, courtesy of my daughter Ilina)